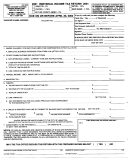

Form 2016lf - Newark Income Tax Page 2

Download a blank fillable Form 2016lf - Newark Income Tax in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 2016lf - Newark Income Tax with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Part 3 - Credit Calculation

17

Newark Tax ( Bring forward from Box 16)

A - Withheld Tax/Other Credits

18

Newark tax withheld on W-2s

19

Other city credit (see instructions)

20

Partnership/S-Corp tax payments

21

Total credits (add 18 - 20)

22

Newark Tax after credits (subtract Box 17-less Box 21)

If Box 22 is $200 or more, see instructions for important information regarding your 2017 tax. You

may be required to file a 2017 Estimated Tax Return.

B - Estimated Tax Payments

23

Estimated 2016 tax payments

24

Taxes carried forward from a prior year

25

Total estimated tax payments (add 23+24)

Part 4 - Payment/Overpayment Information

26

2016 Tax Payment Due (Box 22 less Box 25)

If Box 26 is less than $10.01 - no payment due

Make checks payable to: Newark City Income Tax

27

2016 Overpayment (indicate how to apply below)

If Box 27 is less than $10.01 - no credit or refund

Credit Account

Refund

I hereby declare that the information stated above is true under penalty of perjury.

Signature

Date

Signature

Date

May we contact this preparer?

Signature of Preparer (if different from taxpayer)

Date

Yes

No

Mail to:

Questions?

740-670-7580 phone

Newark City Tax Office

740-670-7581 fax

PO Box 4577

citytax@newarkohio.net

Newark, OH 43058-4577

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6