Form 2016lf - Newark Income Tax Page 5

Download a blank fillable Form 2016lf - Newark Income Tax in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 2016lf - Newark Income Tax with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

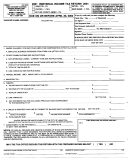

Worksheet C - Other City Credit

Section 1 - Other City Tax Return Credit

If Box 14 of your return is a loss or less than the income taxed on the other city return, do not complete

this section. Please contact our office for assistance.

Name of city

Income taxed

Tax paid

1

2

3

4

5

Total income taxed by other city

Multiply

x 0.01

A

Credit for filing with other cities

Section 2 - W-2 Credit

If you had 2106 Expenses, use Worksheet D to calculate this credit.

A

B

C

D

E

Worksheet A

Box b

Box 18

C x D

City

Column E or

A - B

EIN

Wages

G

1

0.01

2

0.01

3

0.01

4

0.01

5

0.01

B

W-2 credit for taxes withheld for another city

C

Total other city credit (Box A + Box B)

When used, this worksheet is part of your return, please remit a copy with your return.

The following are required to be attached to your return

Copies of W-2s showing other city taxes withheld

Any listing of other city taxes withheld from your employer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6