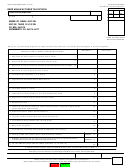

INSTRUCTIONS FOR FORM 1800M

GENERAL INSTRUCTIONS:

1. Every Delaware licensed Farm Winery, Brewery-Pub and Microbrewery must file Form 1800M.

2. This return is to be filed monthly, and is due on or before the last day of the month for the preceding month, except the

May return, which is due on or before June 15.

3. All amounts must be rounded off to the nearest dollar. Do not use cents.

4. A return must be filed for each month, even if there is no tax due.

SPECIFIC INSTRUCTIONS:

Line 1.

Enter on Line 1 your beginning inventory for the month.

Line 2.

Enter on Line 2 the amount of product produced during the reporting month.

Line 3.

Enter on Line 3 the amount of product sold in a previous month and returned in the reporting month. Do not include

on this line product which is sold and returned in the same month.

Line 4.

Add Lines 1, 2 and 3 and enter on Line 4.

Line 5.

Enter on Line 5 the total amount of inventory lost through breakage, spoilage, samples and destruction.

Line 6.

Enter on Line 6 all other inventory loses not from sales, which are not included on Line 5. A full explanation of all

other loses must be attached to the return.

Line 7.

Enter on Line 7 the actual physical inventory at the end of the month.

Line 8.

Subtract Lines 5, 6 and 7 from Line 4 and enter the balance on Line 8.

Line 9.

Enter on Line 9 the total barrels of beer only, which were sold to Instrumentalities of the U.S. Armed Forces.

Line 10.

Enter on Line 10 the total amount of product sold to Out-of-State Distributors for resale in such other state.

Line 11.

Enter on Line 11 the total amount of product sold to Delaware licensed Importers.

Line 12.

Subtract Lines 9, 10 and 11 from Line 8 and enter the balance on Line 12.

Line 14.

Multiply the amount(s) on Line 12 by the Tax Rate(s) on Line 13 and enter on Line 14.

Line 15.

Product sold in a previous month to customers other than the Military (beer only), Out-of-State Distributors and

Delaware Importers and returned in the reporting month on which the Alcoholic Beverage Tax was paid, qualifies for a

credit. Multiply the amount of product returned by the appropriate tax rate and enter the amount in the appropriate

column(s) on Line 15.

Line 16.

Subtract Line 15, Columns A, B, C, from Line 14, Columns A, B, C and enter on Line 16. The amount(s) entered on

Line 16 cannot be less than zero.

Line 17.

If Line 15 is more than Line 14, then subtract Line 14 from Line 15 and enter the amount(s) on Line 17.

Line 18.

Add the amount(s) on Line 17, Columns, A, B, C and enter the total on Line 18.

Line 19.

Enter on Line 19 the amount of credit carryover from the immediately preceding month.

Line 20.

Add Lines 18 and 19 and enter the total on Line 20.

Line 21.

Add the amount(s) on Line 16, Columns A, B, C and enter the total on Line 21.

Line 22.

If the amount on Line 21 is more than the amount on Line 20, then subtract Line 20 from Line 21 and enter the

balance on Line 22. This is the amount of tax due with the filing of the return.

Line 23.

If the amount on Line 20 is more than the amount on Line 21, then subtract Line 21 from Line 20 and enter the

balance on Line 23. This is your Credit Carryover, which should be entered on Line 19 of the next month’s return.

1

1 2

2