Publication 501 - Exemptions, Standard Deduction, And Filing Information - 2001 Page 2

ADVERTISEMENT

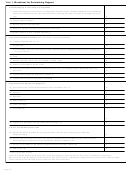

Table 1. 2001 Filing Requirements Chart for Most Taxpayers

Nonresident aliens. If you were a nonresi-

dent alien at any time during the year, the rules

IF your

AND at the

THEN file a return if

and tax forms that apply to you may be different

filing status

end of 2001

your gross income

from those that apply to U.S. citizens. See Publi-

is . . .

you were . . .*

was at least . . .**

cation 519.

Single

under 65

$7,450

Comments and suggestions. We welcome

your comments about this publication and your

65 or older

$8,550

suggestions for future editions.

You can e-mail us while visiting our web site

Head of household

under 65

$9,550

at

You can write to us at the following address:

65 or older

$10,650

under 65 (both spouses)

$13,400

Internal Revenue Service

Technical Publications Branch

Married, filing jointly***

65 or older (one spouse)

$14,300

W:CAR:MP:FP:P

1111 Constitution Ave. NW

65 or older (both spouses)

$15,200

Washington, DC 20224

Married, filing separately

any age

$2,900

We respond to many letters by telephone.

Qualifying widow(er) with

under 65

$10,500

Therefore, it would be helpful if you would in-

dependent child

clude your daytime phone number, including the

65 or older

$11,400

area code, in your correspondence.

*

If you turned age 65 on January 1, 2002, you are considered to be age 65 at the end of 2001.

Useful Items

** Gross income means all income you received in the form of money, goods, property, and

You may want to see:

services that is not exempt from tax, including any income from sources outside the United

States (even if you may exclude part or all of it). Do not include social security benefits unless

Publication

you are married filing a separate return and you lived with your spouse at any time in 2001.

559

Survivors, Executors, and

*** If you didn’t live with your spouse at the end of 2001 (or on the date your spouse died) and

Administrators

your gross income was at least $2,900, you must file a return regardless of your age.

929

Tax Rules for Children and

Dependents

claim; and the amount of the standard deduc-

tion.

Form (and Instructions)

Important Reminders

The first section of this publication explains

1040X

Amended U.S. Individual Income

who must file an income tax return. If you have

Tax Return

Social security number for dependents.

little or no gross income, reading this section will

You must list either the social security number

2848

Power of Attorney and Declaration

help you decide if you have to file a return.

(SSN), individual taxpayer identification number

of Representative

The second section is about who should file

(ITIN), or adoption taxpayer identification num-

a return. Reading this section will help you de-

8332

Release of Claim to Exemption for

ber (ATIN) of every person for whom you claim

cide if you should file a return, even if you are not

Child of Divorced or Separated

an exemption.

required to do so.

Parents

If you do not list the dependent’s SSN, ITIN,

The third section helps you determine which

8814

Parents’ Election To Report

or ATIN, the exemption may be disallowed. See

filing status to use. Filing status is important in

Child’s Interest and Dividends

Social Security Numbers for Dependents, later.

determining whether you must file a return, your

standard deduction, and your tax rate. It also

Election to report child’s unearned income

helps determine what credits you may be enti-

on parent’s return. You may be able to in-

tled to.

Who Must File

clude your child’s interest and dividend income

The fourth section discusses exemptions,

on your tax return by using Form 8814, Parents’

which reduce your taxable income. The discus-

Election To Report Child’s Interest and Divi-

If you are a U.S. citizen or resident, whether you

sions include the social security number re-

dends. If you choose to do this, your child will not

must file a federal income tax return depends

quirement for dependents, the rules for multiple

have to file a return.

upon your gross income, your filing status, your

support agreements, and the rules for divorced

age, and whether you are a dependent. For

or separated parents.

Photographs of missing children. The Inter-

details, see Table 1 and Table 2. You must also

The fifth section gives the rules and dollar

nal Revenue Service is a proud partner with the

file if one of the situations described in Table 3

amounts for the standard deduction — a ben-

National Center for Missing and Exploited Chil-

applies. The filing requirements apply even if

efit for taxpayers who do not itemize their deduc-

dren. Photographs of missing children selected

you owe no tax.

tions. This section also discusses the standard

by the Center may appear in this publication on

You may have to pay a penalty if you are

deduction for taxpayers who are blind or age 65

pages that would otherwise be blank. You can

required to file a return but fail to. If you wilfully

or older, and special rules for dependents. In

help bring these children home by looking at the

fail to file a return, you may be subject to criminal

addition, this section should help you decide

photographs and calling 1 – 800 – THE – LOST

prosecution.

whether you would be better off taking the stan-

(1 – 800 – 843 – 5678) if you recognize a child.

For information on what form to use — Form

dard deduction or itemizing your deductions.

1040EZ, Form 1040A, or Form 1040 — see the

The last section explains how to get tax help

instructions in your tax package.

from the IRS.

Introduction

This publication is for U.S. citizens and resi-

Gross income. Gross income is all income

dent aliens only. If you are a resident alien for

you receive in the form of money, goods, prop-

This publication discusses some tax rules that

the entire year, you must follow the same tax

erty, and services that is not exempt from tax. If

affect every person who may have to file a fed-

rules that apply to U.S. citizens. The rules to

you are married and live with your spouse in a

eral income tax return. It answers some basic

determine if you are a resident or nonresident

community property state, half of any income

questions: who must file; who should file; what

alien are discussed in chapter 1 of Publication

defined by state law as community income may

filing status to use; how many exemptions to

519, U.S. Tax Guide for Aliens.

be considered yours. For a list of community

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21