Publication 501 - Exemptions, Standard Deduction, And Filing Information - 2001 Page 7

ADVERTISEMENT

Considered Unmarried

real estate taxes, insurance on the home, re-

$4,000 and your brother paid $2,000. Your

pairs, utilities, and food eaten in the home.

brother made no other payments towards your

You are considered unmarried on the last day of

mother’s support. Your mother had no income.

Costs you do not include. Do not include in

the tax year if you meet all of the following tests.

Because you paid more than half of the cost of

the cost of upkeep expenses such as clothing,

keeping up your mother’s apartment from Janu-

1) You file a separate return.

education, medical treatment, vacations, life in-

ary 1 until her death, and you can claim an

surance, or transportation. Also, do not include

2) You paid more than half the cost of keep-

exemption for her, you can file as a head of

the rental value of a home you own or the value

ing up your home for the tax year.

household.

of your services or those of a member of your

3) Your spouse did not live in your home dur-

household.

Temporary absences. You and your quali-

ing the last 6 months of the tax year. Your

fying person are considered to live together

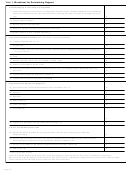

Cost of Keeping Up a Home

spouse is considered to live in your home

even if one or both of you are temporarily absent

even if he or she is temporarily absent due

from your home due to special circumstances

to special circumstances. See Temporary

such as illness, education, business, vacation,

absences, later.

or military service. It must be reasonable to

Amount

assume that the absent person will return to the

4) Your home was the main home of your

You

Total

home after the temporary absence. You must

child, stepchild or adopted child for more

Paid

Cost

continue to keep up the home during the ab-

than half the year or was the main home of

sence.

Property taxes

$

$

your foster child for the entire year. (See

Home of qualifying person, later, for rules

Mortgage interest expense

Kidnapped child. You may be eligible to file

applying to a child’s birth, death, or tempo-

as head of household, even if the child who is

Rent

rary absence during the year.)

your qualifying person has been kidnapped. You

Utility charges

can claim head of household filing status if both

5) You must be able to claim an exemption

Upkeep and repairs

of the following statements are true.

for the child. However, you can still meet

Property insurance

this test if you cannot claim the exemption

Food consumed

1) The child must be presumed by law en-

only because of one of the three situations

on the premises

forcement authorities to have been kid-

described under Exception on page 15.

napped by someone who is not a member

Other household expenses

The general rules for claiming an exemp-

of your family or the child’s family.

Totals

$

$

tion for a dependent are explained later

under Exemptions for Dependents.

2) In the year of the kidnapping, you would

have qualified for head of household filing

Minus total amount you paid

(

)

If you were considered married for part

status if the child had not been kidnapped.

!

of the year and lived in a community

This treatment applies for all years that the

Amount others paid

$

property state (listed earlier under Mar-

CAUTION

child remains kidnapped. However, the last year

ried Filing Separately), special rules may apply

this treatment can apply is the earlier of:

in determining your income and expenses. See

If the total amount you paid is more than the amount others

Publication 555 for more information.

1) The year the child is determined to be

paid, you meet the requirement of paying more than half the

cost of keeping up the home.

dead, or

Nonresident alien spouse. You are consid-

2) The year the child would have reached

ered unmarried for head of household purposes

age 18.

if your spouse was a nonresident alien at any

Qualifying Person

time during the year and you do not choose to

treat your nonresident spouse as a resident

Qualifying Widow(er)

See Table 4 to see who is a qualifying person.

alien. However, your spouse is not a qualifying

With Dependent Child

Any person not described in Table 4 is not a

person for head of household purposes. You

qualifying person.

must have another qualifying person and meet

If your spouse died in 2001, you can use married

the other tests to be eligible to file as a head of

Home of qualifying person. Generally, the

filing jointly as your filing status for 2001 if you

household.

qualifying person must live with you for more

otherwise qualify to use that status. The year of

than half of the year.

Earned income credit. Even if you are con-

death is the last year for which you can file jointly

sidered unmarried for head of household pur-

with your deceased spouse. See Married Filing

Special rule for parent. You may be eligi-

poses because you are married to a nonresident

Jointly, earlier.

ble to file as head of household even if the

alien, you are still considered married for pur-

parent for whom you can claim an exemption

You may be eligible to use qualifying

poses of the earned income credit (unless you

does not live with you. You must pay more than

widow(er) with dependent child as your filing

meet the five tests listed earlier). You are not

half the cost of keeping up a home that was the

status for 2 years following the year of death of

entitled to the credit unless you file a joint return

main home for the entire year for your father or

your spouse. For example, if your spouse died in

with your spouse and meet other qualifications.

mother. You are keeping up a main home for

2000 and you have not remarried, you may be

See Publication 596 for more information.

your father or mother if you pay more than half

able to use this filing status for 2001 and 2002.

the cost of keeping your parent in a rest home or

Choice to treat spouse as resident. You

The rules for using this filing status are ex-

home for the elderly.

are considered married if you choose to treat

plained in detail here.

your spouse as a resident alien. See chapter 1

This filing status entitles you to use joint

Death or birth. You may be eligible to file as

of Publication 519.

return tax rates and the highest standard deduc-

head of household if the individual who qualifies

tion amount (if you do not itemize deductions).

you for this filing status is born or dies during the

This status does not entitle you to file a joint

year. You must have provided more than half of

Keeping Up a Home

return.

the cost of keeping up a home that was the

individual’s main home for more than half of the

To qualify for head of household status, you

How to file. If you file as a qualifying widow(er)

year, or, if less, the period during which the

must pay more than half of the cost of keeping

with dependent child, you can use either Form

individual lived.

up a home for the year. You can determine

1040A or Form 1040. Indicate your filing status

whether you paid more than half of the cost of

by checking the box on line 5 of either form.

Example. You are unmarried. Your mother,

keeping up a home by using the Cost of Keeping

Write the year your spouse died in the space

for whom you can claim an exemption, lived in

Up a Home worksheet, later.

provided on line 5. Use the Married filing jointly

an apartment by herself. She died on Septem-

column of the Tax Table or Schedule Y – 1 of the

Costs you include. Include in the cost of up-

ber 2. The cost of the upkeep of her apartment

keep expenses such as rent, mortgage interest,

for the year until her death was $6,000. You paid

Tax Rate Schedules to figure your tax.

Page 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21