Publication 501 - Exemptions, Standard Deduction, And Filing Information - 2001 Page 8

ADVERTISEMENT

1

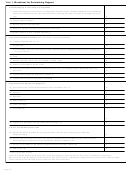

Table 4. Who Is a Qualifying Person For Filing as Head of Household?

IF the person is your . . .

AND . . .

THEN that person is . . .

2

Parent, Grandparent, Brother, Sister,

You can claim an exemption for him or her

A qualifying person

Stepbrother, Stepsister, Stepmother,

Stepfather, Mother-in-law, Father-in-law,

Half brother, Half sister, Brother-in-law,

You cannot claim an exemption for him or

NOT a qualifying person

Sister-in-law, Son-in-law, or

her

Daughter-in-law

Uncle, Aunt, Nephew, or Niece

He or she is related to you by blood and

A qualifying person

2,3

you can claim an exemption for him or her

3

He or she is not related to you by blood

NOT a qualifying person

You cannot claim an exemption for him or

her

4

Child, Grandchild, Stepchild, or Adopted

He or she is single

A qualifying person

child

He or she is married, and you can claim an

A qualifying person

2

exemption for him or her

5

He or she is married, and you cannot claim

NOT a qualifying person

an exemption for him or her

6

Foster child

The child lived with you all year, and you

A qualifying person

2

can claim an exemption for him or her

The child did not live with you all year, or you

NOT a qualifying person

cannot claim an exemption for him or her

1

A person cannot qualify more than one taxpayer to use the head of household filing status for the year.

2

If you can claim an exemption for a person only because of a multiple support agreement, that person cannot be a qualifying person. See Multiple Support

Agreement.

3

You are related by blood to an uncle or aunt if he or she is the brother or sister of your mother or father. You are related by blood to a nephew or niece if

he or she is the child of your brother or sister.

4

This child is a qualifying person even if you cannot claim an exemption for the child.

5

This child is a qualifying person if you could claim an exemption for the child except that the child’s other parent claims the exemption under the special

rules for a noncustodial parent discussed under Support Test for Child of Divorced or Separated Parents.

6

The term “foster child” is defined under Exemptions for Dependents.

Eligibility rules. You are eligible to file your

Death or birth. You may be eligible to file as a

tion you claim in 2001. If you are entitled to two

qualifying widow(er) with dependent child if the

exemptions for 2001, you would deduct $5,800

2001 return as a qualifying widow(er) with de-

($2,900 × 2). But you may lose the benefit of part

child who qualifies you for this filing status is

pendent child if you meet all of the following

born or dies during the year. You must have

or all of your exemptions if your adjusted gross

tests.

provided more than half of the cost of keeping up

income is above a certain amount. See

a home that was the child’s main home during

Phaseout of Exemptions, later.

1) You were entitled to file a joint return with

the entire part of the year he or she was alive.

There are two types of exemptions: personal

your spouse for the year your spouse died.

exemptions and exemptions for dependents.

It does not matter whether you actually

Kidnapped child. You may be eligible to file

While these are both worth the same amount,

filed a joint return.

as a qualifying widow(er) with dependent child,

different rules, discussed later, apply to each

even if the child who qualifies you for this filing

2) You did not remarry before the end of

type.

status has been kidnapped. You can claim quali-

2001.

You usually can claim exemptions for your-

fying widow(er) with dependent child filing status

self, your spouse, and each person you can

3) You have a child, stepchild, adopted child,

if both of the following statements are true.

claim as a dependent. If you are entitled to claim

or foster child for whom you can claim an

an exemption for a dependent (such as your

1) The child must be presumed by law en-

exemption.

child), that dependent cannot claim a personal

forcement authorities to have been kid-

4) You paid more than half of the cost of

exemption on his or her own tax return.

napped by someone who is not a member

keeping up a home that is the main home

of your family or the child’s family.

How to claim exemptions. How you claim an

for you and that child for the entire year,

2) In the year of the kidnapping, you would

exemption on your tax return depends on which

except for temporary absences. See Tem-

have qualified for qualifying widow(er) with

form you file.

porary absences and Keeping Up a Home,

dependent child filing status if the child

discussed earlier under Head of House-

Form 1040EZ filers. If you file Form

had not been kidnapped.

hold.

1040EZ, the exemption amount is combined

with the standard deduction and entered on line

As mentioned earlier, this filing status

!

5.

is only available for 2 years following

Example. John Reed’s wife died in 1999.

the year of death of your spouse.

CAUTION

Form 1040A filers. If you file Form 1040A,

John has not remarried. He has continued dur-

complete lines 6a through 6d. The total number

ing 2000 and 2001 to keep up a home for himself

of exemptions you can claim is the total in the

and his child for whom he can claim an exemp-

box on line 6d. Also complete line 24 by multiply-

tion. For 1999 he was entitled to file a joint return

Exemptions

ing the number in the box on line 6d by $2,900.

for himself and his deceased wife. For 2000 and

2001 he can file as a qualifying widower with a

Form 1040 filers. If you file Form 1040,

dependent child. After 2001 he can file as head

Exemptions reduce your taxable income. Gen-

complete lines 6a through 6d. On line 38, multi-

of household if he qualifies.

erally, you can deduct $2,900 for each exemp-

ply the total exemptions shown in the box on line

Page 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21