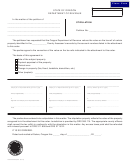

Form 150-303-005 - County Disclosure Form/certificate Of Confidentiality Page 2

ADVERTISEMENT

(2) The Department of Revenue shall make rules

ORS 308.990(5), that these sections have been explained

to the person and that the person is aware of the penal-

governing the confidentiality of information under this

ties for violation of this section. [1981 c. 139 §3]

section.

ORS 308.990 Penalties.

(3) Each officer or employee of the Department of

Revenue or the office of the county assessor to whom

(5) Subject to ORS 153.022, any willful violation of

discloser or access of the information made confiden-

ORS 308.413 or of any rules adopted under ORS 308.413

tial under subsection (1) of this section is given, prior

is punishable, upon conviction, by a fine not exceeding

to beginning employment or the performance of duties

$10,000, or by imprisonment in the county jail for not

involving such disclosure, shall be advised in writing

more than one year, or by both. [Subsections (3) and (4) of

of the provisions of this section and ORS 308.990(5)

1959 Replacement Part enacted as 1955 c.488 §2; subsec-

relating to penalties for the violation of this section,

tions (3) and (4) of 1959 Replacement Part renumbered as

and shall as a condition of employment or performance

part of 321.991; subsection (7) enacted as 1969 c.605 §58;

of duties execute a certificate for the department or the

1971 c.529 §33; 1977 c.884 §11; subsection (5) enacted as

assessor in a form prescribed by the department, stating

1981 c.139 §4; 1997 c.154 §44; 1997 c.541 §88; 1999 c.21 §22;

in substance that the person has read this section and

1999 c.1051 §174]

2

150-303-005 (Rev. 10-10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3