FORM 2210ME INSTRUCTIONS

Purpose of Form.

Use this form to see if you must pay a penalty for underpaying your estimated tax or paying your estimated

tax late. Use Part I to see if you paid enough estimated tax on time. If you did not, use Part II to calculate the penalty on

any underpayment.

Who Must Pay the Underpayment Penalty?

In general, you will owe an underpayment penalty if your 2014 tax liability less

allowable credits and withholding is $1,000 or more and your 2013 tax liability before tax credits, income tax withholding or

any other tax payment(s) for the tax year was $1,000 or more.

NOTE: Maine law disallows the use of the election to pay

estimated tax based on the prior year’s tax liability when an unusual event occurs, such as realization of a large, one-time

capital gain. You must pay 90% of the tax on the unusual event income for the installment period during which the unusual

event occurs. An unusual event occurs when taxable income for the estimated tax installment period exceeds the taxable

income received during the same period in the prior tax year by at least $500,000. If you received unusual event income

during any estimated tax installment period beginning in 2014, you must adjust the estimated tax due on line 9 of

this form for that period. You may be able to use the actual liability method described below to accomplish this

recalculation.

You will not owe an underpayment penalty or need to fi le this form if your 2014 tax liability reduced by allowable credits and

Maine income tax withheld is less than $1,000, or your 2013 tax liability was less than $1,000. Even though you are required

to fi le this form, you will avoid the underpayment penalty if you paid at least 90% of the 2014 tax on time.

Farmers and Fishermen.

If you are a farmer or fi sherman who fi les an income tax return and pays the tax liability in full on

or before March 1 of the following year, no penalty is due.

Payment Method.

Individuals must make four (4) equal installment payments of estimated tax unless they can document

the actual liability for each required installment of estimated tax.

Use the actual liability method if your income varied during the year because, for example, you own a seasonal business

or the majority of your income was received in one payment. Using this method may lower or eliminate the amount of your

quarterly estimated tax payments. To calculate your actual liability, complete the Annualized Installment Worksheet for each

payment due date and check the box on line 17 on this form and on Form 1040ME, line 34b or Form 1041ME, line 8b.

NOTE: Forms are available at

or call 207-624-7894.

Computation of Underpayment Penalty.

Calculate the penalty on the amount of the underpayment of each installment for

the period of underpayment. The penalty rate for calendar year 2014 is .5833% per month or fraction thereof, compounded

monthly. For calendar year 2015, the penalty rate is .5833% per month or fraction thereof, compounded monthly Enter on

line 14 the appropriate rate from the table below that corresponds to the number of months shown on line 13. Multiply the

underpayment on line 11a by the rate on line 14 and enter the result on line 15. Do not calculate the penalty for the 4th

required payment if the tax return for the taxable year is fi led and the tax is paid in full by January 31.

Fiscal-year fi lers may not use the table below.

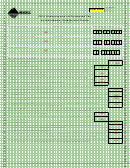

Number of Months

shown on Line 13

1

2

3

4

5

6

7

8

9

10

11

12

Enter this Rate on

line 14, column A .005833 .011701 .017602 .023538 .029509 .035514 .041555 .047631 .053742 .059889 .066071 .072290

Enter this Rate on

line 14, column B .005833 .011701 .017602 .023538 .029509 .035514 .041555 .047631 .053742 .059889

Enter this rate on

line 14, column C .005833 .011701 .017602 .023538 .029509 .035514 .041555

Enter this rate on

line 14, column D .005833 .011701 .017602

1

1 2

2