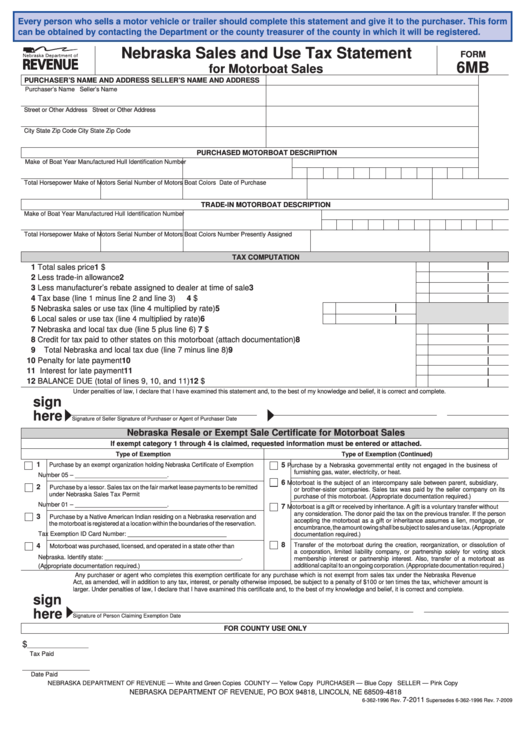

Form 6mb - Nebraska Sales And Use Tax Statement

ADVERTISEMENT

Every person who sells a motor vehicle or trailer should complete this statement and give it to the purchaser. This form

can be obtained by contacting the Department or the county treasurer of the county in which it will be registered.

Nebraska Sales and Use Tax Statement

FORM

6MB

for Motorboat Sales

PURCHASER’S NAME AND ADDRESS

SELLER’S NAME AND ADDRESS

Purchaser’s Name

Seller’s Name

Street or Other Address

Street or Other Address

City

State

Zip Code

City

State

Zip Code

PURCHASED MOTORBOAT DESCRIPTION

Make of Boat

Year Manufactured

Hull Identification Number

Total Horsepower

Make of Motors

Serial Number of Motors

Boat Colors

Date of Purchase

TRADE-IN MOTORBOAT DESCRIPTION

Make of Boat

Year Manufactured

Hull Identification Number

Total Horsepower

Make of Motors

Serial Number of Motors

Boat Colors

Number Presently Assigned

TAX COMPUTATION

1 Total sales price ................................................................................................................................................

1 $

2 Less trade-in allowance ....................................................................................................................................

2

3 Less manufacturer’s rebate assigned to dealer at time of sale .........................................................................

3

4 Tax base (line 1 minus line 2 and line 3) ...........................................................................................................

4 $

5 Nebraska sales or use tax (line 4 multiplied by rate) ..............................................

5

6 Local sales or use tax (line 4 multiplied by rate) .....................................................

6

7 Nebraska and local tax due (line 5 plus line 6) ................................................................................................

7 $

8 Credit for tax paid to other states on this motorboat (attach documentation) ...................................................

8

9 Total Nebraska and local tax due (line 7 minus line 8) .....................................................................................

9

10 Penalty for late payment ...................................................................................................................................

10

11 Interest for late payment ...................................................................................................................................

11

12 BALANCE DUE (total of lines 9, 10, and 11) ....................................................................................................

12 $

Under penalties of law, I declare that I have examined this statement and, to the best of my knowledge and belief, it is correct and complete.

sign

here

Signature of Seller

Signature of Purchaser or Agent of Purchaser

Date

Nebraska Resale or Exempt Sale Certificate for Motorboat Sales

If exempt category 1 through 4 is claimed, requested information must be entered or attached.

Type of Exemption

Type of Exemption (Continued)

1

5

Purchase by an exempt organization holding Nebraska Certificate of Exemption

Purchase by a Nebraska governmental entity not engaged in the business of

furnishing gas, water, electricity, or heat.

Number 05 – ___________________________.

6

Motorboat is the subject of an intercompany sale between parent, subsidiary,

2

Purchase by a lessor. Sales tax on the fair market lease payments to be remitted

or brother-sister companies. Sales tax was paid by the seller company on its

under Nebraska Sales Tax Permit

purchase of this motorboat. (Appropriate documentation required.)

Number 01 – ___________________________.

7

Motorboat is a gift or received by inheritance. A gift is a voluntary transfer without

any consideration. The donor paid the tax on the previous transfer. If the person

3

Purchase by a Native American Indian residing on a Nebraska reservation and

accepting the motorboat as a gift or inheritance assumes a lien, mortgage, or

the motorboat is registered at a location within the boundaries of the reservation.

encumbrance, the amount owing shall be subject to sales and use tax. (Appropriate

Tax Exemption ID Card Number: _____________________________

documentation required.)

8

Transfer of the motorboat during the creation, reorganization, or dissolution of

4

Motorboat was purchased, licensed, and operated in a state other than

a corporation, limited liability company, or partnership solely for voting stock

Nebraska. Identify state: ________________________________________.

membership interest or partnership interest. Also, transfer of a motorboat as

additional capital to an ongoing corporation. (Appropriate documentation required.)

(Appropriate documentation required.)

Any purchaser or agent who completes this exemption certificate for any purchase which is not exempt from sales tax under the Nebraska Revenue

Act, as amended, will in addition to any tax, interest, or penalty otherwise imposed, be subject to a penalty of $100 or ten times the tax, whichever amount is

larger. Under penalties of law, I declare that I have examined this certificate and, to the best of my knowledge and belief, it is correct and complete.

sign

here

Signature of Person Claiming Exemption

Date

FOR COUNTY USE ONLY

$

_____________________

Tax Paid

_______________________

Date Paid

NEBRASKA DEPARTMENT OF REVENUE — White and Green Copies

COUNTY — Yellow Copy

PURCHASER — Blue Copy

SELLER — Pink Copy

NEBRASKA DEPARTMENT OF REVENUE, PO BOX 94818, LINCOLN, NE 68509-4818

7-2011

6-362-1996 Rev.

Supersedes 6-362-1996 Rev. 7-2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2