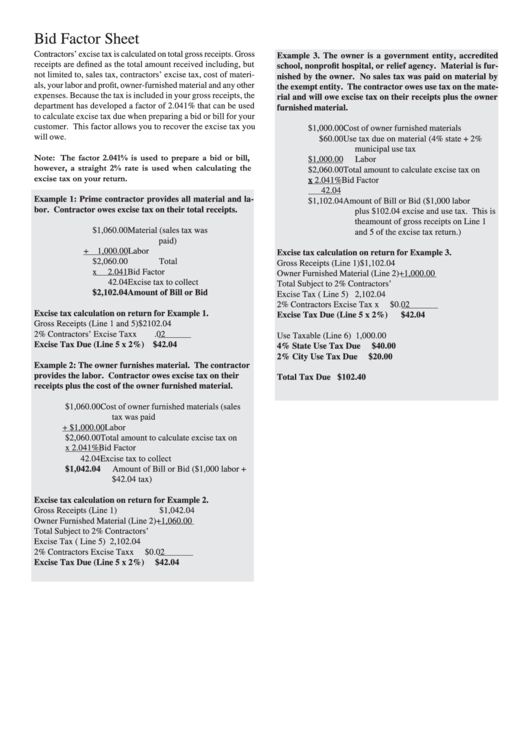

Bid Factor Sheet

Contractors’ excise tax is calculated on total gross receipts. Gross

Example 3. The owner is a government entity, accredited

receipts are defined as the total amount received including, but

school, nonprofit hospital, or relief agency. Material is fur-

not limited to, sales tax, contractors’ excise tax, cost of materi-

nished by the owner. No sales tax was paid on material by

als, your labor and profit, owner-furnished material and any other

the exempt entity. The contractor owes use tax on the mate-

expenses. Because the tax is included in your gross receipts, the

rial and will owe excise tax on their receipts plus the owner

department has developed a factor of 2.041% that can be used

furnished material.

to calculate excise tax due when preparing a bid or bill for your

customer. This factor allows you to recover the excise tax you

$1,000.00

Cost of owner furnished materials

will owe.

$60.00

Use tax due on material (4% state + 2%

municipal use tax

Note: The factor 2.041% is used to prepare a bid or bill,

$1,000.00

Labor

however, a straight 2% rate is used when calculating the

$2,060.00

Total amount to calculate excise tax on

excise tax on your return.

x 2.041%

Bid Factor

42.04

Example 1: Prime contractor provides all material and la-

$1,102.04

Amount of Bill or Bid ($1,000 labor

bor. Contractor owes excise tax on their total receipts.

plus $102.04 excise and use tax. This is

theamount of gross receipts on Line 1

$1,060.00

Material (sales tax was

and 5 of the excise tax return.)

paid)

+ 1,000.00

Labor

Excise tax calculation on return for Example 3.

$2,060.00

Total

Gross Receipts (Line 1)

$1,102.04

x

2.041

Bid Factor

Owner Furnished Material (Line 2) +1,000.00

42.04

Excise tax to collect

Total Subject to 2% Contractors’

$2,102.04

Amount of Bill or Bid

Excise Tax ( Line 5)

2,102.04

2% Contractors Excise Tax

x

$0.02

Excise tax calculation on return for Example 1.

Excise Tax Due (Line 5 x 2%)

$42.04

Gross Receipts (Line 1 and 5)

$2102.04

2% Contractors’ Excise Tax

x

.02

Use Taxable (Line 6)

1,000.00

Excise Tax Due (Line 5 x 2%)

$42.04

4% State Use Tax Due

$40.00

2% City Use Tax Due

$20.00

Example 2: The owner furnishes material. The contractor

provides the labor. Contractor owes excise tax on their

Total Tax Due

$102.40

receipts plus the cost of the owner furnished material.

$1,060.00

Cost of owner furnished materials (sales

tax was paid

+ $1,000.00 Labor

$2,060.00

Total amount to calculate excise tax on

x 2.041%

Bid Factor

42.04

Excise tax to collect

$1,042.04

Amount of Bill or Bid ($1,000 labor +

$42.04 tax)

Excise tax calculation on return for Example 2.

Gross Receipts (Line 1)

$1,042.04

Owner Furnished Material (Line 2) +1,060.00

Total Subject to 2% Contractors’

Excise Tax ( Line 5)

2,102.04

2% Contractors Excise Tax

x

$0.02

Excise Tax Due (Line 5 x 2%)

$42.04

1

1 2

2