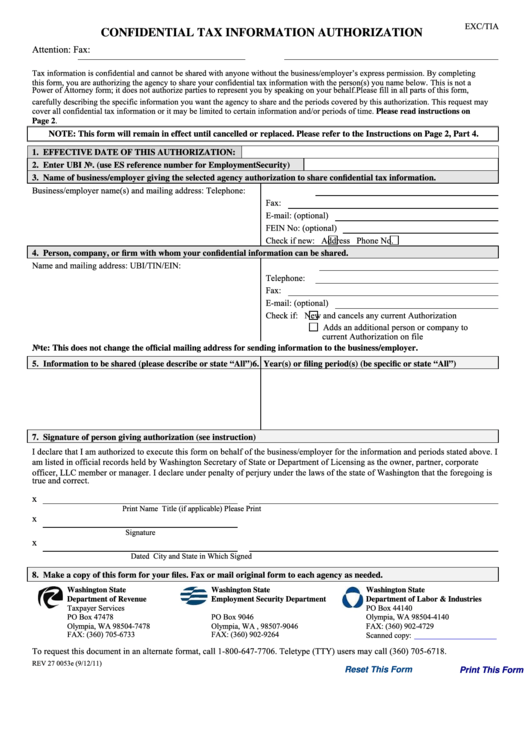

EXC/TIA

CONFIDENTIAL TAX INFORMATION AUTHORIZATION

Attention:

Fax:

Tax information is confidential and cannot be shared with anyone without the business/employer’s express permission. By completing

this form, you are authorizing the agency to share your confidential tax information with the person(s) you name below. This is not a

Power of Attorney form; it does not authorize parties to represent you by speaking on your behalf. Please fill in all parts of this form,

carefully describing the specific information you want the agency to share and the periods covered by this authorization. This request may

cover all confidential tax information or it may be limited to certain information and/or periods of time. Please read instructions on

Page 2.

NOTE: This form will remain in effect until cancelled or replaced. Please refer to the Instructions on Page 2, Part 4.

1. EFFECTIVE DATE OF THIS AUTHORIZATION:

2. Enter UBI No. (use ES reference number for Employment Security)

3. Name of business/employer giving the selected agency authorization to share confidential tax information.

Business/employer name(s) and mailing address:

Telephone:

Fax:

E-mail: (optional)

FEIN No: (optional)

Check if new:

Address

Phone No.

4. Person, company, or firm with whom your confidential information can be shared.

Name and mailing address:

UBI/TIN/EIN:

Telephone:

Fax:

E-mail: (optional)

Check if:

New and cancels any current Authorization

Adds an additional person or company to

current Authorization on file

Note: This does not change the official mailing address for sending information to the business/employer.

5. Information to be shared (please describe or state “All”)

6. Year(s) or filing period(s) (be specific or state “All”)

7. Signature of person giving authorization (see instruction)

I declare that I am authorized to execute this form on behalf of the business/employer for the information and periods stated above. I

am listed in official records held by Washington Secretary of State or Department of Licensing as the owner, partner, corporate

officer, LLC member or manager. I declare under penalty of perjury under the laws of the state of Washington that the foregoing is

true and correct.

x

Print Name

Title (if applicable) Please Print

x

Signature

x

Dated

City and State in Which Signed

8. Make a copy of this form for your files. Fax or mail original form to each agency as needed.

Washington State

Washington State

Washington State

Department of Revenue

Employment Security Department

Department of Labor & Industries

Taxpayer Services

PO Box 44140

PO Box 47478

PO Box 9046

Olympia, WA 98504-4140

Olympia, WA 98504-7478

Olympia, WA , 98507-9046

FAX: (360) 902-4729

FAX: (360) 705-6733

FAX: (360) 902-9264

Scanned copy:

estechsupport@lni.wa.gov

To request this document in an alternate format, call 1-800-647-7706. Teletype (TTY) users may call (360) 705-6718.

REV 27 0053e (9/12/11)

Reset This Form

Print This Form

1

1 2

2