Pa Schedule M, Reconciliation Of Federal Taxable Income To Pa Taxable Income Instructions

ADVERTISEMENT

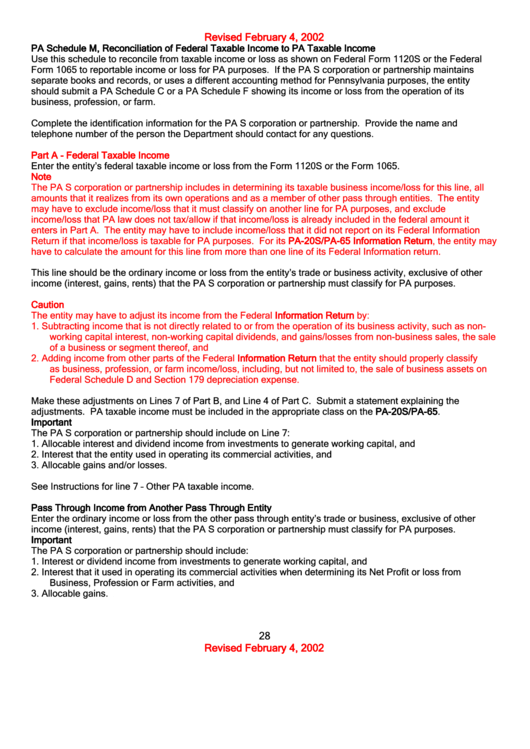

Revised February 4, 2002

PA Schedule M, Reconciliation of Federal Taxable Income to PA Taxable Income

Use this schedule to reconcile from taxable income or loss as shown on Federal Form 1120S or the Federal

Form 1065 to reportable income or loss for PA purposes. If the PA S corporation or partnership maintains

separate books and records, or uses a different accounting method for Pennsylvania purposes, the entity

should submit a PA Schedule C or a PA Schedule F showing its income or loss from the operation of its

business, profession, or farm.

Complete the identification information for the PA S corporation or partnership. Provide the name and

telephone number of the person the Department should contact for any questions.

Part A - Federal Taxable Income

Enter the entity’s federal taxable income or loss from the Form 1120S or the Form 1065.

Note

The PA S corporation or partnership includes in determining its taxable business income/loss for this line, all

amounts that it realizes from its own operations and as a member of other pass through entities. The entity

may have to exclude income/loss that it must classify on another line for PA purposes, and exclude

income/loss that PA law does not tax/allow if that income/loss is already included in the federal amount it

enters in Part A. The entity may have to include income/loss that it did not report on its Federal Information

Return if that income/loss is taxable for PA purposes. For its PA-20S/PA-65 Information Return, the entity may

have to calculate the amount for this line from more than one line of its Federal Information return.

This line should be the ordinary income or loss from the entity’s trade or business activity, exclusive of other

income (interest, gains, rents) that the PA S corporation or partnership must classify for PA purposes.

Caution

The entity may have to adjust its income from the Federal Information Return by:

1.

Subtracting income that is not directly related to or from the operation of its business activity, such as non-

working capital interest, non-working capital dividends, and gains/losses from non-business sales, the sale

of a business or segment thereof, and

2.

Adding income from other parts of the Federal Information Return that the entity should properly classify

as business, profession, or farm income/loss, including, but not limited to, the sale of business assets on

Federal Schedule D and Section 179 depreciation expense.

Make these adjustments on Lines 7 of Part B, and Line 4 of Part C. Submit a statement explaining the

adjustments. PA taxable income must be included in the appropriate class on the PA-20S/PA-65.

Important

The PA S corporation or partnership should include on Line 7:

1.

Allocable interest and dividend income from investments to generate working capital, and

2.

Interest that the entity used in operating its commercial activities, and

3.

Allocable gains and/or losses.

See Instructions for line 7 – Other PA taxable income.

Pass Through Income from Another Pass Through Entity

Enter the ordinary income or loss from the other pass through entity’s trade or business, exclusive of other

income (interest, gains, rents) that the PA S corporation or partnership must classify for PA purposes.

Important

The PA S corporation or partnership should include:

1.

Interest or dividend income from investments to generate working capital, and

2.

Interest that it used in operating its commercial activities when determining its Net Profit or loss from

Business, Profession or Farm activities, and

3.

Allocable gains.

28

Revised February 4, 2002

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5