Form Pa-20s/pa-65 Schedule M - Reconciling Of Federal Income To Pa Income By Pa Income Class - 2002

ADVERTISEMENT

0207916008

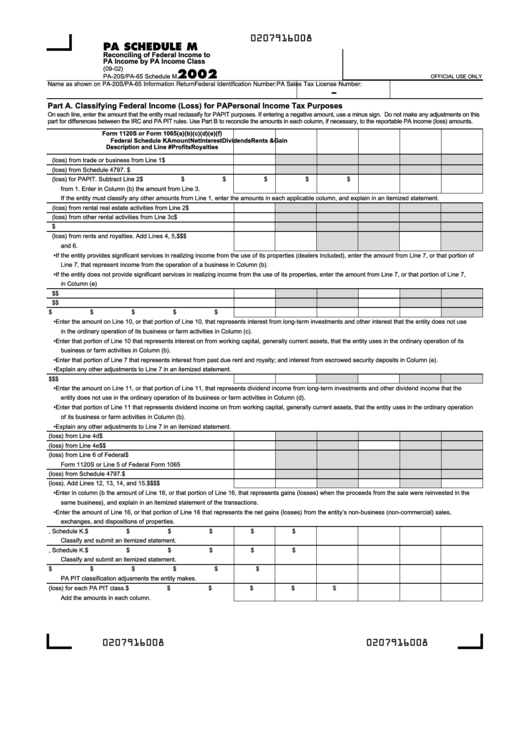

PA SCHEDULE M

Reconciling of Federal Income to

PA Income by PA Income Class

(09-02)

2002

PA-20S/PA-65 Schedule M

OFFICIAL USE ONLY

Name as shown on PA-20S/PA-65 Information Return

Federal Identification Number:

PA Sales Tax License Number:

—

Part A. Classifying Federal Income (Loss) for PA Personal Income Tax Purposes

On each line, enter the amount that the entity must reclassify for PA PIT purposes. If entering a negative amount, use a minus sign. Do not make any adjustments on this

part for differences between the IRC and PA PIT rules. Use Part B to reconcile the amounts in each column, if necessary, to the reportable PA income (loss) amounts.

Form 1120S or Form 1065

(a)

(b)

(c)

(d)

(e)

(f)

Federal Schedule K

Amount

Net

Interest

Dividends

Rents &

Gain

Description and Line #

Profits

Royalties

1. Ordinary income (loss) from trade or business from Line 1

$

2. Net gain (loss) from Schedule 4797.

$

3. Adjusted ordinary income (loss) for PA PIT. Subtract Line 2

$

$

$

$

$

$

from 1. Enter in Column (b) the amount from Line 3.

If the entity must classify any other amounts from Line 1, enter the amounts in each applicable column, and explain in an itemized statement.

4. Net income (loss) from rental real estate activities from Line 2

$

5. Net income (loss) from other rental activities from Line 3c

$

6. Royalty income from Line 4c

$

7. Total income (loss) from rents and royalties. Add Lines 4, 5,

$

$

$

and 6.

• If the entity provides significant services in realizing income from the use of its properties (dealers included), enter the amount from Line 7, or that portion of

Line 7, that represent income from the operation of a business in Column (b).

• If the entity does not provide significant services in realizing income from the use of its properties, enter the amount from Line 7, or that portion of Line 7,

in Column (e)

8. Portfolio interest income from Line 4a

$

$

9. Other portfolio interest income from Line f. Do not enter losses

$

$

10. Total interest income. Add Lines 8 and 9

$

$

$

$

$

• Enter the amount on Line 10, or that portion of Line 10, that represents interest from long-term investments and other interest that the entity does not use

in the ordinary operation of its business or farm activities in Column (c).

• Enter that portion of Line 10 that represents interest on from working capital, generally current assets, that the entity uses in the ordinary operation of its

business or farm activities in Column (b).

• Enter that portion of Line 7 that represents interest from past due rent and royalty; and interest from escrowed security deposits in Column (e).

• Explain any other adjustments to Line 7 in an itemized statement.

11. Portfolio dividend income from Line 4b

$

$

$

• Enter the amount on Line 11, or that portion of Line 11, that represents dividend income from long-term investments and other dividend income that the

entity does not use in the ordinary operation of its business or farm activities in Column (d).

• Enter that portion of Line 11 that represents dividend income on from working capital, generally current assets, that the entity uses in the ordinary operation

of its business or farm activities in Column (b).

• Explain any other adjustments to Line 7 in an itemized statement.

12. Net short-term capital gain (loss) from Line 4d

$

13. Net long-term capital gain (loss) from Line 4e

$

$

14. Net section 1231 gain (loss) from Line 6 of Federal

$

Form 1120S or Line 5 of Federal Form 1065

15. Net gain (loss) from Schedule 4797.

$

16. Total gain (loss). Add Lines 12, 13, 14, and 15.

$

$

$

$

• Enter in column (b the amount of Line 16, or that portion of Line 16, that represents gains (losses) when the proceeds from the sale were reinvested in the

same business), and explain in an itemized statement of the transactions.

• Enter the amount of Line 16, or that portion of Line 16 that represents the net gains (losses) from the entity’s non-business (non-commercial) sales,

exchanges, and dispositions of properties.

17. Other income from Line 6 of Federal Form 1120, Schedule K.

$

$

$

$

$

$

Classify and submit an itemized statement.

18. Other income from Line 7 of Federal Form 1065, Schedule K.

$

$

$

$

$

$

Classify and submit an itemized statement.

19. Other adjustments. Explain in an itemized statement any other

$

$

$

$

$

$

PA PIT classification adjusments the entity makes.

20. Total income (loss) for each PA PIT class.

$

$

$

$

$

$

Add the amounts in each column.

0207916008

0207916008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2