Form Kw-3 - Employer'S/payor'S Annual Withholding Tax Return

ADVERTISEMENT

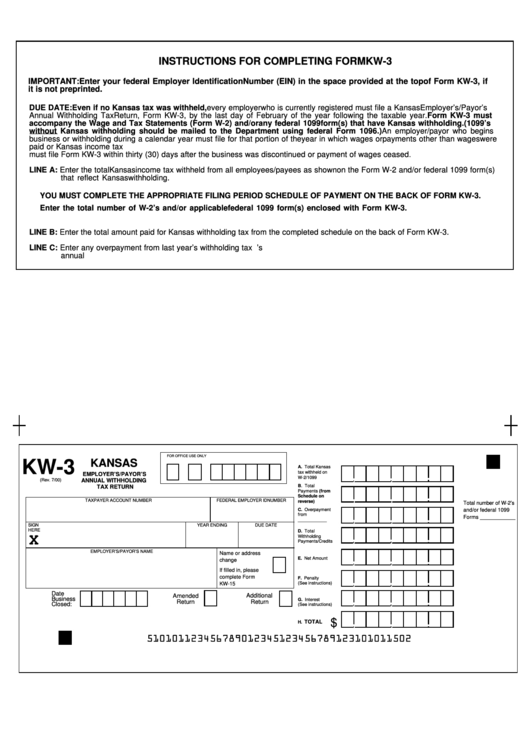

INSTRUCTIONS FOR COMPLETING FORM KW-3

IMPORTANT: Enter your federal Employer Identification Number (EIN) in the space provided at the top of Form KW-3, if

it is not preprinted.

DUE DATE: Even if no Kansas tax was withheld, every employer who is currently registered must file a Kansas Employer’s/Payor’s

Annual Withholding Tax Return, Form KW-3, by the last day of February of the year following the taxable year. Form KW-3 must

accompany the Wage and Tax Statements (Form W-2) and/or any federal 1099 form(s) that have Kansas withholding. (1099’s

without Kansas withholding should be mailed to the Department using federal Form 1096.) An employer/payor who begins

business or withholding during a calendar year must file for that portion of the year in which wages or payments other than wages were

paid or Kansas income tax withheld. An employer/payor who discontinues business or discontinues withholding during a calendar year

must file Form KW-3 within thirty (30) days after the business was discontinued or payment of wages ceased.

LINE A: Enter the total Kansas income tax withheld from all employees/payees as shown on the Form W-2 and/or federal 1099 form(s)

that reflect Kansas withholding.

YOU MUST COMPLETE THE APPROPRIATE FILING PERIOD SCHEDULE OF PAYMENT ON THE BACK OF FORM KW-3.

Enter the total number of W-2’s and/or applicable federal 1099 form(s) enclosed with Form KW-3.

LINE B: Enter the total amount paid for Kansas withholding tax from the completed schedule on the back of Form KW-3.

LINE C: Enter any overpayment from last year’s withholding tax payments. The amount should have been indicated on the prior year’s

annual return. Enter the year from which this overpayment is being carried over.

FOR OFFICE USE ONLY

KW-3

KANSAS

A. Total Kansas

.

,

,

tax withheld on

EMPLOYER’S/PAYOR’S

W-2/1099

(Rev. 7/00)

ANNUAL WITHHOLDING

B. Total

TAX RETURN

.

,

,

Payments (from

Schedule on

TAXPAYER ACCOUNT NUMBER

FEDERAL EMPLOYER ID NUMBER

reverse)

Total number of W-2’s

C. Overpayment

and/or federal 1099

,

,

.

from

Forms ____________

____________

SIGN

YEAR ENDING

DUE DATE

HERE

D. Total

,

,

.

X

Withholding

Payments/Credits

EMPLOYER’S/PAYOR’S NAME

,

,

Name or address

.

E. Net Amount

change

If filled in, please

,

,

.

complete Form

F. Penalty

(See instructions)

KW-15

Date

,

,

.

Amended

Additional

Business

G. Interest

Return

Return

Closed:

(See instructions)

,

,

.

$

TOTAL

H.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2