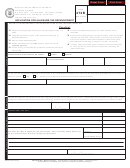

Schedule E-7 (State Form 49192) - Apportionment For Interstate Transportation Tax Years 2007-2010 Page 3

ADVERTISEMENT

Indiana Department of Revenue

Schedule E-7 - Apportionment Schedule for Interstate Transportation

Page 2

(for Tax Years 2007-2010)

Line 23. Add line 20, line 21, and line 22. Enter the total here.

Line 12. Enter the total amount of payroll for nontransportation

Line 24. Multiply line 20 by line 3 to determine the value of

personnel everywhere. This entry will include wages paid to

property and rents from Indiana transportation activity.

bookkeepers, clerks, secretaries, etc.

Line 25. Enter the average value of property in Indiana from

Line 13. Enter the total of line 11 and line 12.

nontransportation business activity.

Line 14. Multiply line 11 by line 3 to determine the amount of

Line 26. Enter the rents paid during the tax period for

Indiana payroll for transportation personnel.

nontransportation property in Indiana, at eight times the annual

rental rate.

Line 15. Enter the total amount of payroll for nontransportation

personnel in Indiana.

Line 27. Add line 24, line 25, and line 26. Enter the total here.

Line 16. Enter the total of line 14 and line 15.

Line 28. Divide line 27 by line 23 to determine the Indiana

property percent factor.

Line 17. Divide line 16 by line 13 to determine the Indiana

payroll percent factor.

Line 29. Add line 10, line 17, and line 28. Enter the result here.

Indiana Property Factor

Indiana Apportionment Percentage

Fixed property (buildings and land used in business, shop and

Line 30. To determine the Indiana apportionment percentage,

terminal equipment, trucks, cars, and all other tangible property

the total value of the denominator for tax periods beginning after

connected with the transportation business) should be assigned

Dec. 31, 2006 varies according to the phase-in schedule:

to the state in which the property is located. The value of mobile

equipment used in interstate transportation will be assigned

•

For a tax period that begins in 2007, divide line 29 by 5;

based on total miles traveled in Indiana compared to total miles

•

For a tax period that begins in 2008, divide line 29 by 6.67;

everywhere.

•

For a tax period that begins in 2009, divide line 29 by 10;

Line 18. Enter the total average value of all mobile transportation

•

For a tax period that begins in 2010, divide line 29 by 20.

revenue-producing equipment. Property owned by the transportation

company is valued at original cost. Add the beginning and ending

The payroll and property factors are each valued as a factor of

values of all transportation equipment and divide by 2 to determine

1 in the apportionment formula. In instances in which there is a

the average value.

total absence of one of these factors (e.g., no payroll anywhere),

Line 19. Enter rents paid during the tax period for mobile

divide the sum of the percentages by the number of the

transportation revenue-producing property rented and/or

remaining factor values present in the apportionment formula.

purchased through a lease contract, less any subrentals. Rented/

Examples: In the case of a taxpayer who lacks either the payroll

leased property is valued at eight times its annual rental rate.

Purchased transportation is defined as “the taxpayer’s use of

or property factor in the three-factor formula, the taxpayer’s

motor vehicle owned and operated by...for which a charge is

business income will be apportioned by using the remaining

incurred.” Any charge incurred for purchased transportation

factor or factors. For 2009, divide line 29 by 9. This denominator

should be included in the calculation of rented property. When

is the remaining value of the payroll (1) or property (1) factor

the charge for the use of purchased property cannot be separated

plus the value of the revenue (8) factor for 2007.

from the charge for compensating the operator of the property,

the value of the total charge is reduced by 20 percent. Caution:

If both the payroll and property factors are absent, divide line

The 20 percent attributable to operator compensation should not

29 by 8 for 2009. This denominator is the remaining value of the

be included in the payroll factor.

revenue factor.

Line 20. Add lines 18 and 19 to determine the total value of

If the revenue factor (line 10) is absent (e.g., for a start-up

transportation property everywhere.

company), you must divide line 29 by 2. The denominator is the

total value of the payroll and property factors for 2009.

Line 21. Enter the average value of property from

nontransportation business activity everywhere. This will

Carry the resulting average Indiana apportionment percentage to

include all buildings, land, shop and terminal equipment, and

the appropriate line on the annual Indiana income tax return.

nonrevenue-producing vehicles.

Line 22. Multiply annual rents paid during the tax period for

nontransportation property everywhere by 8 and enter the

amount.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3