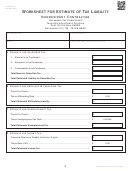

Form BT-194

Revised 5-2012

Worksheet for Estimate of Tax Liability

Nonresident Contractor

Oklahoma Tax Commission

Taxpayer Assistance Division

Post Office Box 26920

Oklahoma City, OK 73126-0920

Contract Number

Contract Amount

Name

Federal Employer Identification Number

A. Estimate for Sales/Use Tax

1. Material to be Purchased .................................................................................. $

2. Equipment to be Purchased .............................................................................. $

3. Consumables to be Purchased ......................................................................... $

Total Base for Sales/Use Tax ................................................................................ $

Total Estimated Liability for Sales/Use Tax .........................................................

$

B. Estimate for Employee Withholding Tax

Payroll for Project .................................................................................................... $

Times Withholding Rate .......................................................................................... X

0.05

Total Estimated Withholding Liability .................................................................. $

C. Estimate for Unemployment Tax

Payroll for Project .................................................................................................... $

Times Unemployment Tax Rate............................................................................... X

0.03125

Total Estimated Unemployment Tax .................................................................... $

D. Estimate for Income Tax

Projected Oklahoma Taxable Income for Project ....................................................

$

Times Rate of 6% .................................................................................................... X

0.06

Total Estimated Income Tax ................................................................................. $

Worksheet continued on page E...

D

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26