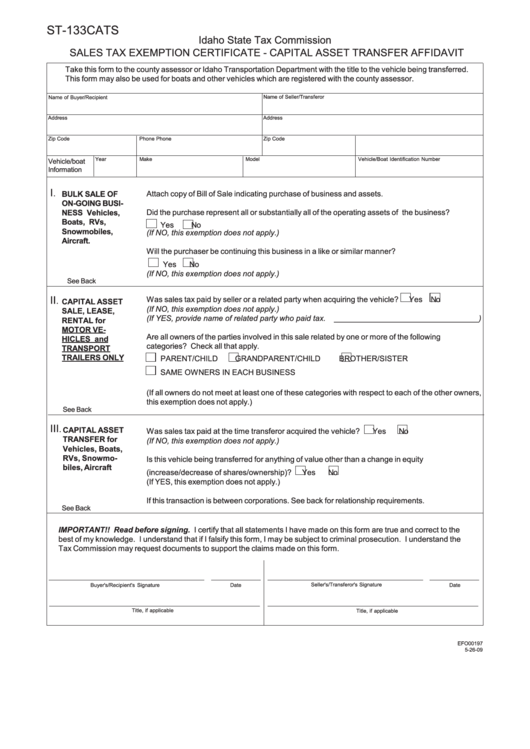

ST-133CATS

Idaho State Tax Commission

SALES TAX EXEMPTION CERTIFICATE - CAPITAL ASSET TRANSFER AFFIDAVIT

Take this form to the county assessor or Idaho Transportation Department with the title to the vehicle being transferred.

This form may also be used for boats and other vehicles which are registered with the county assessor.

Name of Seller/Transferor

Name of Buyer/Recipient

Address

Address

Phone

Zip Code

Phone

Zip Code

Year

Make

Model

Vehicle/Boat Identification Number

Vehicle/boat

Information

I

.

Attach copy of Bill of Sale indicating purchase of business and assets.

BULK SALE OF

ON-GOING BUSI-

NESS Vehicles,

Did the purchase represent all or substantially all of the operating assets of the business?

Boats, RVs,

Yes

No

Snowmobiles,

(If NO, this exemption does not apply.)

Aircraft.

Will the purchaser be continuing this business in a like or similar manner?

Yes

No

(If NO, this exemption does not apply.)

See Back

II

Was sales tax paid by seller or a related party when acquiring the vehicle?

Yes

No

.

CAPITAL ASSET

(If NO, this exemption does not apply.)

SALE, LEASE,

(If YES, provide name of related party who paid tax.

_________________________________)

RENTAL for

MOTOR VE-

Are all owners of the parties involved in this sale related by one or more of the following

HICLES and

categories? Check all that apply.

TRANSPORT

TRAILERS ONLY

PARENT/CHILD

GRANDPARENT/CHILD

BROTHER/SISTER

SAME OWNERS IN EACH BUSINESS

(If all owners do not meet at least one of these categories with respect to each of the other owners,

this exemption does not apply.)

See Back

III

.

CAPITAL ASSET

Was sales tax paid at the time transferor acquired the vehicle?

Yes

No

TRANSFER for

(If NO, this exemption does not apply.)

Vehicles, Boats,

RVs, Snowmo-

Is this vehicle being transferred for anything of value other than a change in equity

biles, Aircraft

(increase/decrease of shares/ownership)?

Yes

No

(If YES, this exemption does not apply.)

If this transaction is between corporations. See back for relationship requirements.

See Back

IMPORTANT!! Read before signing. I certify that all statements I have made on this form are true and correct to the

best of my knowledge. I understand that if I falsify this form, I may be subject to criminal prosecution. I understand the

Tax Commission may request documents to support the claims made on this form.

Seller's/Transferor's Signature

Buyer's/Recipient's Signature

Date

Date

Title, if applicable

Title, if applicable

EFO00197

5-26-09

1

1 2

2