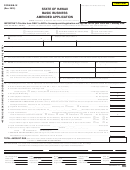

Form It-Qbe - Qualified Business Expansion Application Page 2

ADVERTISEMENT

IT-QBE

Please check one

New facility construction

Expansion of existing GA facility

Is the project located in more than one county? Yes

No

If yes, please indicate each county. _______________________________________________

TYPE OF BUSINESS (IF BUSINESS IS A CORPORATION, LIST STATE OF INCORPORATION)

A.

Sole Proprietor (SSN)

Partnership/LLC

C Corporation

S Corporation

Other (Specify)

1) Federal Employer ID Number

Georgia Withholding Number

2) NAICS Code (six-digit level)

County/Tier

/

B. EXPLAIN THE PROPOSED BUSINESS EXPANSION AND HOW IT WILL HAVE A BENEFICIAL

ECONOMIC IMPACT ON THE REGION FOR WHICH IT IS PLANNED.

(ATTACH ADDITIONAL PAGES IF NECCESSARY).

C. QUALIFIED BUSINESS EXPANSION MEANS THE CREATION OF AT LEAST 500, NEW FULL-TIME

JOBS WITHIN A TAXABLE YEAR.

1) How many full-time jobs existed at the end of the prior taxable year (by facility if applicable)?

2) How many new full-time jobs existed at the end of the current taxable year (by facility if applicable)?

3) Total job increase (line 2 minus line 1) (by facility if applicable)

4) List the Georgia income tax liability for the expansion taxable year

5) Indicate the total amount of Georgia withholding payments for the current taxable year.

6) Average hourly employee wage of new jobs (by facility if applicable)

7) Total annual payroll expense including benefits of new jobs (by facility if applicable )

8) Please provide the costs of any special infrastructure –roads, sewage, etc.- built by any government body

to accommodate the project. (Please specify funding source, e.g. Federal, State, County)

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6