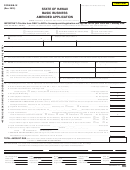

Form It-Qbe - Qualified Business Expansion Application Page 3

ADVERTISEMENT

IT-QBE

9) Please provide the Georgia net taxable income for the past five years:

1)________________(expansion year)

2)________________

3)________________

4)________________

5)________________

10) Projected increase in company/taxpayer gross revenue (in dollars) associated with the expansion in the

year of the expansion and in the following year.

Year of expansion ____________________

Year 2 _____________________________

11) Prepare a spreadsheet which projects corporate income tax for the next ten years including allowable

credits, if this Qualified Business Expansion application is not granted. The spreadsheet should also project

corporate income tax with allowable credits, and how it changes for the next ten years if you are granted

QBE credit (reflect both income and withholding tax reductions).

12) If applicable, please describe any anticipated layoffs or closings either in the county in which the Project is

planned or anywhere else in Georgia. Please specify by county and year the number of any layoffs

and/

or

closings planned for the subsequent four years for all the company’s facilities in the state.

D. 1. DOES THE AMOUNT OF CREDITS EARNED UNDER SECTION 48-7-40 EXCEED 50 PERCENT

OF YOUR LIABILITY?

Yes

No

PLEASE INDICATE THE AMOUNT OF CREDITS ESTABLISHED UNDER SECTION 48-7-40 AND

2.

CARRIED FORWARD FROM TAX YEARS ENDING PRIOR TO JANUARY 1, 2001, WHICH YOU

ARE REQUESTING TO BE CONVERTED TO WITHHOLDING ELIGIBLE CREDITS.

SUMMARY OF PROJECT COSTS

E.

–PREPARE BY COUNTY

1. Land Cost ............................................................................................$ ________________________

2. Building Cost (new construction) .......................................................$ ________________________

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6