Clear This Page

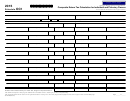

2015

Oregon Department of Revenue

Composite Return Tax Calculation for Individual and Fiduciary Owners

01371501010000

OC1

Schedule

Use a separate schedule for each type of owner

Name of pass-through entity (PTE)

Federal employer identification number (FEIN)

Name of PTE contact

Phone number of PTE contact

PTE year end

Type of owners on this schedule (select one per schedule):

Individuals

Estates

Trusts. Total number of this owner type included on this return:

Electing nonresident owner information (see instructions)

1.

Nonresident owner name

SSN or FEIN

(a) Filing status

(b) Ownership percentage

(c) Share of federal income

(d) Share of Oregon-source distributive income

(e) Oregon income tax

(f) Oregon surplus credit

(g) Share of estimated tax paid

(h) Interest on underpayment of tax

2.

Nonresident owner name

SSN or FEIN

(a) Filing status

(b) Ownership percentage

(c) Share of federal income

(d) Share of Oregon-source distributive income

(e) Oregon income tax

(f) Oregon surplus credit

(g) Share of estimated tax paid

(h) Interest on underpayment of tax

SSN or FEIN

3.

Nonresident owner name

(a) Filing status

(b) Ownership percentage

(c) Share of federal income

(d) Share of Oregon-source distributive income

(e) Oregon income tax

(f) Oregon surplus credit

(g) Share of estimated tax paid

(h) Interest on underpayment of tax

Nonresident owner name

SSN or FEIN

(a) Filing status

(b) Ownership percentage

4.

(c) Share of federal income

(d) Share of Oregon-source distributive income

(e) Oregon income tax

(f) Oregon surplus credit

(g) Share of estimated tax paid

(h) Interest on underpayment of tax

5.

Nonresident owner name

SSN or FEIN

(a) Filing status

(b) Ownership percentage

(c) Share of federal income

(d) Share of Oregon-source distributive income

(e) Oregon income tax

(f) Oregon surplus credit

(g) Share of estimated tax paid

(h) Interest on underpayment of tax

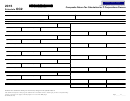

6.

Nonresident owner name

SSN or FEIN

(a) Filing status

(b) Ownership percentage

(c) Share of federal income

(d) Share of Oregon-source distributive income

(e) Oregon income tax

(f) Oregon surplus credit

(g) Share of estimated tax paid

(h) Interest on underpayment of tax

SSN or FEIN

7.

Nonresident owner name

(a) Filing status

(b) Ownership percentage

(c) Share of federal income

(d) Share of Oregon-source distributive income

(e) Oregon income tax

(f) Oregon surplus credit

(g) Share of estimated tax paid

(h) Interest on underpayment of tax

Nonresident owner name

SSN or FEIN

(a) Filing status

(b) Ownership percentage

8.

(c) Share of federal income

(d) Share of Oregon-source distributive income

(e) Oregon income tax

(f) Oregon surplus credit

(g) Share of estimated tax paid

(h) Interest on underpayment of tax

(g) Total

(h) Total

9. Total for each column: (e), (f), (g), and (h)

(e) Total

(f) Total

Include this schedule with your Form OC, Oregon Composite Return.

Use additional copies of this page for additional nonresident owners electing to join the composite filing.

Use separate schedules for each owner type listed above. If using more than one page, total all pages for that owner type on line 9 of the last page.

Page ______ of ______

150-101-154 (Rev. 4-16)

1

1 2

2 3

3 4

4 5

5