Reset Form

Print Form

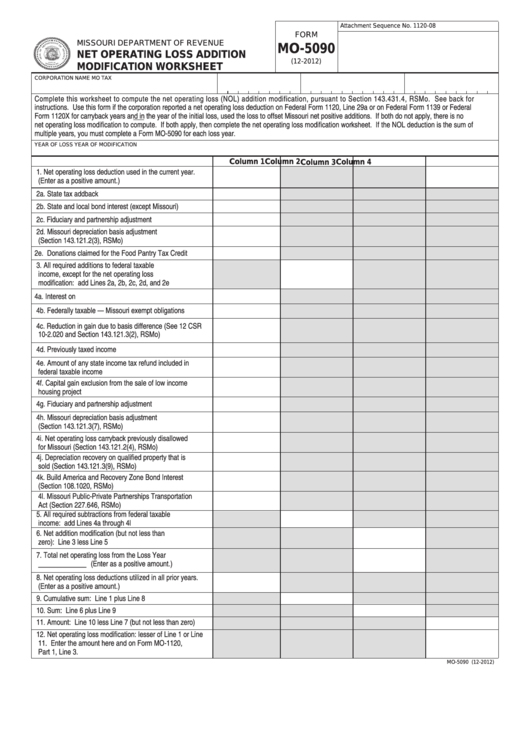

Attachment Sequence No. 1120-08

FORM

MISSOURI DEPARTMENT OF REVENUE

MO-5090

NET OPERATING LOSS ADDITION

(12-2012)

MODIFICATION WORKSHEET

CORPORATION NAME

MO TAX I.D. NUMBER

CHARTER NUMBER

FEDERAL I.D. NUMBER

Complete this worksheet to compute the net operating loss (NOL) addition modification, pursuant to Section 143.431.4, RSMo. See back for

instructions. Use this form if the corporation reported a net operating loss deduction on Federal Form 1120, Line 29a or on Federal Form 1139 or Federal

Form 1120X for carryback years and in the year of the initial loss, used the loss to offset Missouri net positive additions. If both do not apply, there is no

net operating loss modification to compute. If both apply, then complete the net operating loss modification worksheet. If the NOL deduction is the sum of

multiple years, you must complete a Form MO-5090 for each loss year.

YEAR OF LOSS

YEAR OF MODIFICATION

Column 1

Column 2

Column 3

Column 4

1. Net operating loss deduction used in the current year.

(Enter as a positive amount.)

2a. State tax addback

2b. State and local bond interest (except Missouri)

2c. Fiduciary and partnership adjustment

2d. Missouri depreciation basis adjustment

(Section 143.121.2(3), RSMo)

2e. Donations claimed for the Food Pantry Tax Credit

3. All required additions to federal taxable

income, except for the net operating loss

modification: add Lines 2a, 2b, 2c, 2d, and 2e

4a. Interest on U.S. Government obligations

4b. Federally taxable — Missouri exempt obligations

4c. Reduction in gain due to basis difference (See 12 CSR

10-2.020 and Section 143.121.3(2), RSMo)

4d. Previously taxed income

4e. Amount of any state income tax refund included in

federal taxable income

4f. Capital gain exclusion from the sale of low income

housing project

4g. Fiduciary and partnership adjustment

4h. Missouri depreciation basis adjustment

(Section 143.121.3(7), RSMo)

4i. Net operating loss carryback previously disallowed

for Missouri (Section 143.121.2(4), RSMo)

4j. Depreciation recovery on qualified property that is

sold (Section 143.121.3(9), RSMo)

4k. Build America and Recovery Zone Bond Interest

(Section 108.1020, RSMo)

4l. Missouri Public-Private Partnerships Transportation

Act (Section 227.646, RSMo)

5. All required subtractions from federal taxable

income: add Lines 4a through 4l

6. Net addition modification (but not less than

zero): Line 3 less Line 5

7. Total net operating loss from the Loss Year

___________

(Enter as a positive amount.)

8. Net operating loss deductions utilized in all prior years.

(Enter as a positive amount.)

9. Cumulative sum: Line 1 plus Line 8

10. Sum: Line 6 plus Line 9

11. Amount: Line 10 less Line 7 (but not less than zero)

12. Net operating loss modification: lesser of Line 1 or Line

11. Enter the amount here and on Form MO-1120,

Part 1, Line 3.

MO-5090 (12-2012)

1

1 2

2