INSTRUCTIONS

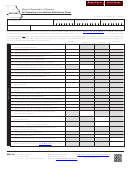

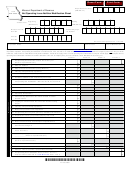

Use Form MO-5090, Net Operating Loss Addition Modification Worksheet if the corporation reported a net operating loss

(NOL) deduction on Federal Form 1120, Line 29a, Federal Form 1139, or Federal Form 1120X for carryback years and

in the year of the initial loss, used the loss to offset Missouri net positive additions. If both do not apply, there is no net

operating loss modification. If both apply, then complete the net operating loss addition modification worksheet. If the

NOL deduction is the sum of multiple years, you must complete a Form MO-5090 for each loss year.

1.

Enter on Line 1, Columns 1 and 4, the amount of the net operating loss deduction attributable to the loss year

from Federal Form 1120, Line 29a of the carryover year or from Federal Form 1139 or Federal Form 1120X for

carryback years. This is the amount of the deduction utilized in the current year.

2.

Enter on Lines 2a through 2e all required additions from the loss year to federal taxable income, except for the net

operating loss modification.

3.

Add Lines 2a through 2d and enter the total on Line 3 to compute all required additions from the loss year to

federal taxable income.

4.

Enter on Lines 4a through 4l all required subtractions from federal taxable income from the loss year.

5.

Add Lines 4a through 4l and enter the total on Line 5 to compute all required subtractions from the loss year from

federal taxable income.

6.

Subtract Line 5 from Line 3 and enter on Line 6 (but not less than zero). This will give you the net addition

modification, as the amount that all required additions exceeds all required subtractions.

7.

Enter the total amount of the net operating loss from Federal Form 1120, Line 30 of the loss year in Column 3 and

enter the tax year of the net operating loss in the blank provided.

8.

Enter the amount of the net operating loss deduction utilized in prior years from Federal Form 1120, Line 29a from all

prior carryover years of this loss year or from Federal Form 1139 or Federal Form 1120X from the carryback years.

9.

Add Lines 1 and 8 and enter on Line 9

10.

Add Lines 6 and 9 and enter on Line 10.

11.

Subtract Line 7 from Line 10 (but not less than zero) and enter on Line 11.

12.

Enter the lesser of Line 1 or 11 on Line 12 and also on Form MO-1120, Part 1, Line 3.

Note: You must specifically identify each loss year that is part of the net operating loss deduction and a separate Form

MO-5090 must be completed for each loss year.

Note: The above items are each considered to be a positive amount for purposes of this calculation. If the result of

combining amounts is negative, use zero.

If you have questions you may call 573-751-4541.

Frequently Asked Questions

1.

If a taxpayer has incurred a net operating loss, when is a net operating loss addition modification computed?

A net operating loss addition modification is computed when a net operating loss deduction is claimed. If there

was a net operating loss for the tax year 2011 and the taxpayer carried it back two years and claimed a net

operating loss deduction on an amended federal return for tax year 2009, then a net operating loss addition

modification would be computed for the 2009 amended Missouri return.

2.

Is the Net Operating Loss Addition Modification computed for the year of the loss?

No, it is computed for the year a net operating loss deduction is used.

3.

If a taxpayer has claimed a net operating loss deduction on its federal return and in the year the initial loss was

incurred, its Missouri addition modifications are less than its subtraction modifications, does it have to compute a

net operating loss modification?

No, there is no net operating loss addition modification attributable to that net operating loss because in the year of

the initial loss, the Missouri addition modifications were less than the Missouri subtraction modifications.

4.

If the net operating loss deduction is composed of net operating loss amounts from more than one year, is there

more than one net operating loss addition modification?

Yes, a net operating loss addition modification must be computed for each net operating loss included in the net

operating loss deduction.

5.

If more than one net operating loss addition modification is computed, in what order are the amounts computed?

The net operating loss addition modifications are computed in the same order the net operating losses are used as

net operating loss deductions for federal income tax purposes.

1

1 2

2