Form CT-1120K Instructions

• Community antenna television system companies

Complete this form in blue or black ink only.

expire at the same time, tax credits must be taken

in the order in which the corporation may receive

tax under Chapter 211;

Form CT-1120K, Business Tax Credit Summary, must

the maximum benefit.

• Utility companies tax under Chapter 212; and

be attached to Form CT-1120, Corporation Business

• Public service companies tax under Chapter 212a.

3. Any tax credit that may not be carried back to a

Tax Return, or the applicable tax form whenever tax

preceding income year and that may not be carried

credits from the current income year are being claimed

If the taxpayer is claiming a tax credit against more

forward to a succeeding income year must be

or carryforward tax credit balances exist from a

than one tax type, a duplicate Form CT-1120K and

claimed next, in the order in which the corporation

prior year.

applicable tax credit forms must be attached to each

may receive the maximum benefit.

Taxpayers subject to the domestic and foreign insurance

tax return for which a tax credit is being claimed.

4. Any tax credit that may be carried forward to a

premiums tax and the health care centers tax must

Any tax credit balance that remains after applying the tax

succeeding income year must be claimed next.

complete Form CT-207K, Insurance / Health Care Tax

credits to the current year tax may be carried forward

Any tax credit carryforward that will expire first must

Credit Schedule, and attach it to Form CT-207, Insurance

or carried back as provided in the Connecticut General

be claimed before any tax credit carryforward that

Premiums Tax Return Domestic Companies; Form

Statutes, if the tax credit has not expired.

will expire later. If the tax credit carryforwards will

CT-207F, Insurance Premiums Tax Return Nonresident

expire at the same time, tax credits must be taken

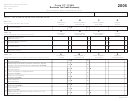

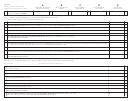

Part I-A — Financial Institutions Tax Credit

and Foreign Companies; or Form CT-207HCC, Health

in the order in which the corporation may receive

Care Center Tax Return.

Line 1 - Enter in Column A the tax credit

the maximum benefit.

earned in 2012. Enter in Column B the amount

Taxpayers subject to the personal income tax must

5. The Electronic Data Processing Equipment

actually applied to the corporation business tax.

complete Form CT-IT, Income Tax Credit Summary,

Property tax credit must be applied last, after all

The total amount applied in Column B cannot exceed

and attach it to Form CT-1040, Connecticut Resident

other tax credits have been applied.

the amount in Part II, Line 1.

Income Tax Return; Form CT-1040NR/PY, Connecticut

Limits on Credits: The amount of tax credits

Nonresident or Part-Year Resident Income Tax Return;

Part I-B — Tax Credits With Carryback Provisions

otherwise allowable against the corporation business

Form CT-1040X, Amended Connecticut Income Tax

Enter in Column A all of the tax credits earned in

tax for any income year shall not exceed 70% of the

Return for Individuals; or Form CT-1041, Connecticut

2012 that have a carryback provision. The tax credits

amount of tax due prior to the application of the tax

Income Tax Return for Trusts and Estates.

indicated here are applied to the current year tax

credit. However, for the 2012 income year, tax credits

Additional information about Connecticut tax credits

first. Any remaining balance may be claimed against

can exceed the 70% limitation if the taxpayer has an

is available in Informational Publication 2010(13),

a preceding year tax by filing Form CT-1120X,

average monthly net employment gain of greater than

Guide to Connecticut Business Tax Credits.

Amended Corporation Business Tax Return, or the

zero, as calculated on Form CT-1120 TCE, Tax Credit

Corporation business tax credits must be applied in a

appropriate amended tax return. If carrying forward a

Cap Extension.

specific order, where a corporation is eligible to claim

housing program contribution tax credit, also complete

No tax credit can be applied against the minimum tax

more than one tax credit. In no event, however, shall

Part I-D.

of $250.

any tax credit be claimed more than once. The order

Enter in Column B the amount actually applied to

Form CT-1120K must be attached to the tax returns

is as follows:

the corporation business tax. The total of Column B

covered under the following Connecticut General

1. The Financial Institutions tax credit must be applied

cannot exceed the amount in Part II, Line 3.

Statutes chapters, when tax credits from the current

before any other tax credit.

Enter in Column C the amount applied to taxes

income year are being claimed or when carryforward

2. Any tax credit that may be carried back to a

other than the corporation business tax. The total of

tax credit balances exist from the prior year:

preceding income year must be applied after the

Column C cannot exceed the amount in Part III,

• Corporation business tax under Chapter 208;

Financial Institutions tax credit, but before any other

Line 1.

• Unrelated business income tax under Chapter 208a;

tax credit. Any tax credit carryback that will expire

Enter in Column D the amount of tax credit carried

first must be claimed before any tax credit carryback

• Air carrier tax under Chapter 209;

back to prior years.

that will expire later. If the tax credit carrybacks will

• Railroad companies tax under Chapter 210;

Form CT-1120K (Rev. 12/12)

Page 4 of 5

1

1 2

2 3

3 4

4 5

5