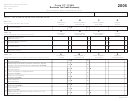

Line 2 - Enter the Neighborhood Assistance Act (NAA)

Line 20 - If claiming the Housing Program Contribution

Part III — Tax Credits Applied to Taxes Other Than

tax credit, Part I-B, Line 3, must be completed first.

tax credit. Any remaining balance may be carried

Corporation Business Tax

back to the two immediately preceding income

Enter the applicable tax credit amounts in the spaces

Part III enables a corporation to account for any tax

years.

provided.

credits applied to the following other taxes:

Line 3 - Enter the Housing Program Contribution tax

Part I-E — Electronic Data Processing Equipment

• Unrelated business income tax under Chapter 208a;

credit computed on Form CT-1120 HPC, Housing

Property Tax Credit

• Air carrier tax under Chapter 209;

Program Contribution Tax Credit. Any remaining

Enter in Column A the amount of tax credit carried

• Railroad companies tax under Chapter 210;

balance may be carried back to the five immediately

forward from previous income years. Enter in

• Cable and community antenna television system

preceding income years. If claiming a tax credit

Column B the amount of tax credit claimed in the

companies tax under Chapter 211;

carryforward, also complete Part I-D, Line 20. See

current income year. Enter in Column C the amount

• Utility companies tax under Chapter 212;

Part I-D, Line 20 instructions.

applied to the corporation business tax. The amount

• Public service companies tax under Chapter 212a;

in Column C cannot exceed the amount in Part II,

Part I-C — Tax Credits Without Carryback or

and

Line 9. Enter in Column D any amount applied to

Carryforward Provisions

• Surplus lines brokers tax under Chapter 701d.

taxes other than the corporation business tax. Enter

Enter in Column A the credit amounts claimed in the

in Column E the tax credit carryforward amount.

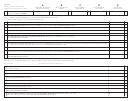

Enter the name of the tax to which the tax credit is

current income year.

The Electronic Data Processing Equipment Property

being applied. For each tax, attach a duplicate Form

Enter in Column B the amount actually applied to the

tax credit may be applied only after all other tax

CT-1120K and applicable tax credit forms. If applying

corporation business tax. The total of Column B cannot

credits have been applied and must be applied first

tax credits to more than one tax other than corporation

exceed the amount in Part II, Line 5.

to the corporation business tax and then to any other

business tax, attach supplemental copies of Part III to

Enter in Column C the amount applied to taxes

applicable taxes.

Form CT-1120K

other than the corporation business tax. The total of

Part II — Tax Credits Applied to the Corporation

Use Form CT-207K, Insurance/Health Care Tax Credit

Column C cannot exceed the amount in Part III,

Business Tax

Schedule, to claim tax credits against the:

Line 3.

If the corporation is filing a combined return, complete

• Domestic and foreign insurance premiums tax under

Part I-D — Tax Credits With Carryforward Provisions

Chapter 207;

Form CT-1120CR, Combined Corporation Business

Part I-D enables a corporation to account for any tax

• Health care centers tax under Chapter 207; and

Tax Return, Schedule KC, and do not complete this

credits with carryforward provisions. This section also

part.

• Hospital and medical services tax under Chapter 207.

identifies any amounts of Research and Development

This section enables a corporation to apply its tax

Use Schedule CT-IT Credit, Income Tax Credit

or Research and Experimental Expenditures tax

credits in the order required by Conn. Gen. Stat.

Summary, to claim tax credits against the:

credits exchanged with the state for a credit refund.

§12-217aa. This section also limits the amount of

• Income tax under Chapter 229, not including the tax

Enter in Column A the tax credit carryforward amount

tax credits that may be applied to the corporation

from previous income years. Enter in Column B the

under Conn. Gen. Stat. §12-207.

business tax.

tax credit amount claimed for the current income year.

Enter in Column C the tax credit amount applied to

the corporation business tax for the current income

year. Enter in Column D the tax credit amount applied

to taxes other than the corporation business tax,

if applicable, in the current income year or the

amount of Research and Development or Research

and Experimental Expenditures tax credits exchanged

with the state for a tax credit refund. Enter in Column E

the tax credit carryforward amount.

Page 5 of 5

Form CT-1120K (Rev. 12/12)

1

1 2

2 3

3 4

4 5

5