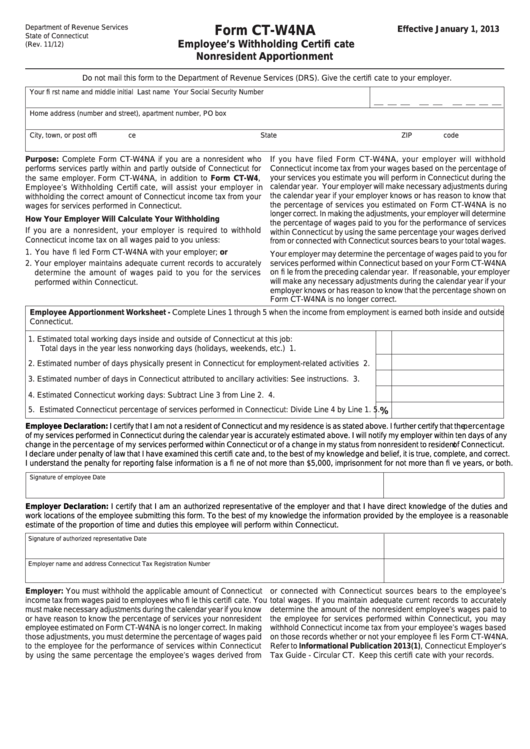

Form Ct-W4na - Employee'S Withholding Certifi Cate Nonresident Apportionment

ADVERTISEMENT

Department of Revenue Services

Form CT-W4NA

Effective January 1, 2013

State of Connecticut

Employee’s Withholding Certifi cate

(Rev. 11/12)

Nonresident Apportionment

Do not mail this form to the Department of Revenue Services (DRS). Give the certifi cate to your employer.

Your fi rst name and middle initial

Last name

Your Social Security Number

Home address (number and street), apartment number, PO box

City, town, or post offi ce

State

ZIP code

Purpose: Complete Form CT-W4NA if you are a nonresident who

If you have filed Form CT-W4NA, your employer will withhold

performs services partly within and partly outside of Connecticut for

Connecticut income tax from your wages based on the percentage of

your services you estimate you will perform in Connecticut during the

the same employer. Form CT-W4NA, in addition to Form CT-W4,

calendar year. Your employer will make necessary adjustments during

Employee’s Withholding Certifi cate, will assist your employer in

the calendar year if your employer knows or has reason to know that

withholding the correct amount of Connecticut income tax from your

the percentage of services you estimated on Form CT-W4NA is no

wages for services performed in Connecticut.

longer correct. In making the adjustments, your employer will determine

How Your Employer Will Calculate Your Withholding

the percentage of wages paid to you for the performance of services

If you are a nonresident, your employer is required to withhold

within Connecticut by using the same percentage your wages derived

Connecticut income tax on all wages paid to you unless:

from or connected with Connecticut sources bears to your total wages.

1. You have fi led Form CT-W4NA with your employer; or

Your employer may determine the percentage of wages paid to you for

services performed within Connecticut based on your Form CT-W4NA

2. Your employer maintains adequate current records to accurately

on fi le from the preceding calendar year. If reasonable, your employer

determine the amount of wages paid to you for the services

will make any necessary adjustments during the calendar year if your

performed within Connecticut.

employer knows or has reason to know that the percentage shown on

Form CT-W4NA is no longer correct.

Employee Apportionment Worksheet - Complete Lines 1 through 5 when the income from employment is earned both inside and outside

Connecticut.

1. Estimated total working days inside and outside of Connecticut at this job:

Total days in the year less nonworking days (holidays, weekends, etc.)

1.

2. Estimated number of days physically present in Connecticut for employment-related activities

2.

3. Estimated number of days in Connecticut attributed to ancillary activities: See instructions.

3.

4. Estimated Connecticut working days: Subtract Line 3 from Line 2.

4.

5. Estimated Connecticut percentage of services performed in Connecticut: Divide Line 4 by Line 1.

5.

%

Employee Declaration: I certify that I am not a resident of Connecticut and my residence is as stated above. I further certify that the percentage

of my services performed in Connecticut during the calendar year is accurately estimated above. I will notify my employer within ten days of any

change in the percentage of my services performed within Connecticut or of a change in my status from nonresident to resident of Connecticut.

I declare under penalty of law that I have examined this certifi cate and, to the best of my knowledge and belief, it is true, complete, and correct.

I understand the penalty for reporting false information is a fi ne of not more than $5,000, imprisonment for not more than fi ve years, or both.

Signature of employee

Date

Employer Declaration: I certify that I am an authorized representative of the employer and that I have direct knowledge of the duties and

work locations of the employee submitting this form. To the best of my knowledge the information provided by the employee is a reasonable

estimate of the proportion of time and duties this employee will perform within Connecticut.

Signature of authorized representative

Date

Employer name and address

Connecticut Tax Registration Number

Employer: You must withhold the applicable amount of Connecticut

or connected with Connecticut sources bears to the employee’s

income tax from wages paid to employees who fi le this certifi cate. You

total wages. If you maintain adequate current records to accurately

must make necessary adjustments during the calendar year if you know

determine the amount of the nonresident employee’s wages paid to

or have reason to know the percentage of services your nonresident

the employee for services performed within Connecticut, you may

employee estimated on Form CT-W4NA is no longer correct. In making

withhold Connecticut income tax from your employee’s wages based

those adjustments, you must determine the percentage of wages paid

on those records whether or not your employee fi les Form CT-W4NA.

to the employee for the performance of services within Connecticut

Refer to Informational Publication 2013(1), Connecticut Employer’s

by using the same percentage the employee’s wages derived from

Tax Guide - Circular CT. Keep this certifi cate with your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2