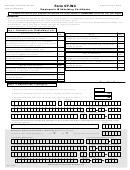

Form Ct-W4na - Employee'S Withholding Certifi Cate Nonresident Apportionment Page 2

ADVERTISEMENT

Line Instructions for Employee Apportionment Worksheet

When to File Form CT-W4NA

You must complete Form CT-W4NA if any of the following is true for

Line 1: Enter the estimated total number of days you expect to work

inside and outside of Connecticut during the calendar year. A work day

the calendar year:

does not include days on which you are not required to work, such as

• You are a nonresident who performs services partly within and

holidays, sick days, vacations, paid or unpaid leave, but does include

partly outside of Connecticut for the same employer; or

days in which you perform activities that are ancillary to your primary

• The percentage of services you perform within Connecticut has

work duties.

changed from the percentage you indicated on the most recent

Line 2: Enter the number of days you expect to be physically present in

Form CT-W4NA on fi le with your employer; or

Connecticut for any employment-related activities including duties that

• Your residency status has changed from resident to nonresident.

may be considered ancillary to your primary work duties. If you spend

General Instructions: Before you complete Form CT-W4NA, review

a working day partly inside and partly outside of Connecticut, treat the

the information you have provided on Form CT-W4 and make any

day as having been spent entirely inside Connecticut.

necessary changes. If you have not completed Form CT-W4, you

Line 3: Enter the estimated number of days in Connecticut that you

must complete and fi le it with your employer before you complete

expect to perform activities that are ancillary to your primary work duties.

Form CT-W4NA.

An activity performed in Connecticut may be considered ancillary if the

Complete the certifi cate, sign it, and return it to your employer.

activity is secondary to your primary work duties normally performed

Employee Apportionment Worksheet

at a base of operations outside of Connecticut. Days on which you

A nonresident or part-year resident who is employed in Connecticut

perform ancillary activities are not considered Connecticut working

during the nonresidency period is required to use the Employee

days in calculating the estimated percentage of services performed

Apportionment Worksheet on Page 1 to estimate the percentage of

in Connecticut during the calendar year.

time spent performing services in Connecticut if the employer does not

For More Information: Call the Department of Revenue Services

maintain adequate current records to accurately determine the amount

(DRS) during business hours, Monday through Friday:

of wages paid for services performed within the state.

• 800-382-9463 (Connecticut calls from outside the Greater Hartford

The apportionment must be a reasonable estimate of your time spent

calling area only); or

performing services in Connecticut. If you discover later that the

• 860-297-5962 (from anywhere).

percentage originally reported to your employer is no longer accurate,

TTY, TDD, and Text Telephone users only may transmit inquiries

you must complete and provide a new Form CT-W4NA to your employer.

anytime by calling 860-297-4911.

Regardless of the estimated percentage computed on this

Forms and Publications: Visit the DRS website at

worksheet, you must file Form CT-1040NR/PY, Connecticut

to download and print Connecticut tax forms and publications.

Nonresident and Part-Year Resident Income Tax Return, for the

taxable year and report your Connecticut-sourced wages based

on the actual days worked in Connecticut and the actual income

received. The percentage indicated on this form does not determine

the amount of Connecticut income tax that may be due when fi ling your

Form CT-1040NR/PY.

Form CT-W4NA (Back) (Rev. 11/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2