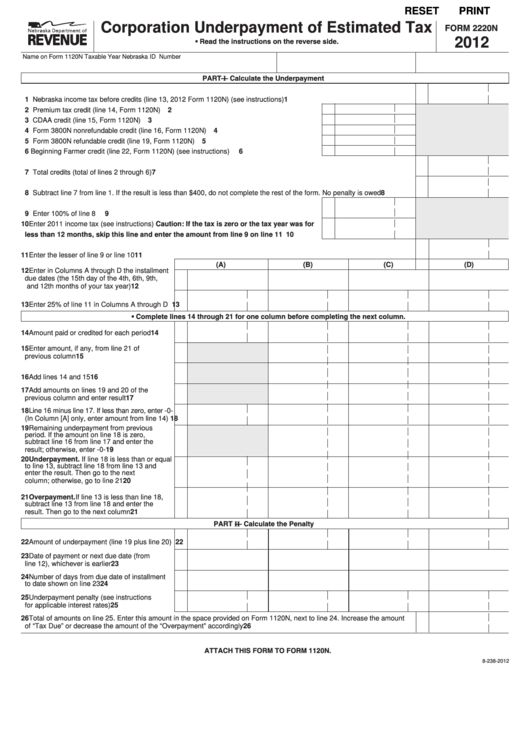

RESET

PRINT

Corporation Underpayment of Estimated Tax

FORM 2220N

2012

• Read the instructions on the reverse side.

Name on Form 1120N

Taxable Year

Nebraska ID Number

PART I — Calculate the Underpayment

1 Nebraska income tax before credits (line 13, 2012 Form 1120N) (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Premium tax credit (line 14, Form 1120N) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 CDAA credit (line 15, Form 1120N) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Form 3800N nonrefundable credit (line 16, Form 1120N) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Form 3800N refundable credit (line 19, Form 1120N) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Beginning Farmer credit (line 22, Form 1120N) (see instructions) . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Total credits (total of lines 2 through 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Subtract line 7 from line 1 . If the result is less than $400, do not complete the rest of the form . No penalty is owed . . . . . . . . . .

8

9 Enter 100% of line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Enter 2011 income tax (see instructions) Caution: If the tax is zero or the tax year was for

less than 12 months, skip this line and enter the amount from line 9 on line 11 . . . . . . . . . 10

11 Enter the lesser of line 9 or line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

(A)

(B)

(C)

(D)

12 Enter in Columns A through D the installment

due dates (the 15th day of the 4th, 6th, 9th,

and 12th months of your tax year) . . . . . . . . . . 12

13 Enter 25% of line 11 in Columns A through D

13

• Complete lines 14 through 21 for one column before completing the next column.

14 Amount paid or credited for each period . . . . . 14

15 Enter amount, if any, from line 21 of

previous column . . . . . . . . . . . . . . . . . . . . . . . 15

16 Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . 16

17 Add amounts on lines 19 and 20 of the

previous column and enter result . . . . . . . . . . 17

18 Line 16 minus line 17 . If less than zero, enter -0-

(In Column [A] only, enter amount from line 14) 18

19 Remaining underpayment from previous

period . If the amount on line 18 is zero,

subtract line 16 from line 17 and enter the

result; otherwise, enter -0- . . . . . . . . . . . . . . . . 19

20 Underpayment. If line 18 is less than or equal

to line 13, subtract line 18 from line 13 and

enter the result . Then go to the next

column; otherwise, go to line 21 . . . . . . . . . . . 20

21 Overpayment. If line 13 is less than line 18,

subtract line 13 from line 18 and enter the

result . Then go to the next column . . . . . . . . . 21

PART II — Calculate the Penalty

22 Amount of underpayment (line 19 plus line 20) 22

23 Date of payment or next due date (from

line 12), whichever is earlier . . . . . . . . . . . . . . 23

24 Number of days from due date of installment

to date shown on line 23 . . . . . . . . . . . . . . . . . 24

25 Underpayment penalty (see instructions

for applicable interest rates) . . . . . . . . . . . . . . 25

26 Total of amounts on line 25 . Enter this amount in the space provided on Form 1120N, next to line 24 . Increase the amount

of “Tax Due” or decrease the amount of the “Overpayment” accordingly . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

ATTACH THIS FORM TO FORM 1120N.

8-238-2012

1

1 2

2 3

3