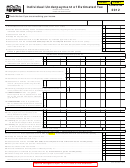

INSTRUCTIONS FOR SCHEDULE K-210

If any due date falls on a Saturday, Sunday, or legal holiday, substitute the next regular work day.

WHO MAY USE THIS SCHEDULE

This exception applies if the amount on line 7 exceeds the amount

on line 9a or 9b (as applicable). If you are a farmer or fisher, you will

If you are an individual taxpayer (including farmer or fisher), use

only complete the last column on line 9b.

this schedule to determine if your income tax was fully paid

For example, to figure the first column, total your income from

throughout the year by withholding and/or estimated tax payments. If

January 1 to March 31, 2012 and multiply by 4. Subtract your

your 2012 tax due (line 17 of the K-40 – DO NOT include

deductions (standard or itemized) and your exemption allowance

compensating tax from line 18 of the K-40), less withholding and tax

amount. Using this net annualized income figure, compute the tax.

credits (excluding estimated tax payments made) is $500 or more,

Multiply the tax by the percentage rate in the first column.

you may be subject to an underpayment of estimated tax penalty

and must complete this form.

Repeat these instructions for the remaining three columns, using

the multiplication factors given above to annualize the income for

Taxpayers (other than farmers or fishers) are not required to make

a payment for the January 15

th

quarter if a Form K-40 was filed and

that period. Enclose a schedule showing your computation of

the tax was paid in full on or before January 31, 2013.

annualized income and tax amounts. If the amount on line 7 (for

each column) is equal to or greater than the amount on line 9a

Farmers & Fishers: If at least two-thirds of your annual gross

(for each column), or line 9b, for farmers or fishers – no penalty

income is from farming or fishing and you filed Form K-40 and paid

the tax on or before March 1, 2013, you may be exempt from any

is due and no further entries are required.

penalty for underpayment of estimated tax. If so, write on line 1

“Exempt–farmer/fisher”, and do not complete the rest of this schedule.

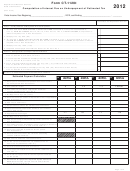

PART II – FIGURING THE PENALTY

However, if you meet this gross income test, but did not file a

LINE 10: Enter on line 10 the amount of underpayment of tax,

return and pay the tax on or before March 1, 2013, you must use this

which is the lesser of one of the following computations:

schedule to determine if you owe a penalty for underpayment of

estimated tax.

• Line 8 less line 7; or,

• Line 9a less line 7; or,

COMPLETING THIS SCHEDULE

• Line 9b less line 7

Enter your name and your Social Security number in the space

LINE 11: This line contains the due date of each installment for a

provided at the top of this schedule.

calendar year taxpayer.

LINES 1 through 4: Complete these lines based on information on

LINE 12: The number of days on line 12 are precomputed for a

your income tax return for this tax year and the prior tax year.

calendar year taxpayer that made timely payments. If you did not

If you did not file an income tax return for the prior tax year, or if you

make timely payments, you should disregard the precomputed

did file a return but your income tax balance (line 17, Form K-40)

number of days on line 12 and compute the number of days on each

was zero, then enter zero on line 3 of this schedule.

quarter to the date paid.

PART I – EXCEPTIONS TO THE PENALTY

EXAMPLE: If you paid the 6/15/12 installment on 6/28/12 the

number of days to enter on line 12, column 2 will be computed

You will NOT be subject to a penalty if your 2012 tax payments

from 6/15/12 to 6/28/12, which equals 13 days. If you then

(line 7) equal or exceed the amounts for one of the exceptions (lines

paid the next quarter timely at 9/17/12, the number of days

8 or 9a or 9b) for the same payment period.

will be from 9/17/12 to 1/15/13, which equals the 120 days

LINE 5: Multiply the amount on line 4 by the percentage shown in

(105 already entered + 15).

each column of line 5.

LINE 13: The 5% penalty rate begins in column 3 for a calendar

LINE 6: Enter the cumulative amount of timely paid estimated tax

year taxpayer, therefore no entry is required in columns 1 and 2. The

payment made in each quarter. For example, Column 3 will be the

15 days in the 3

rd

column are from 1/1/13 to 1/15/13. If you did not

total of your withholding and estimated tax payments made from

make timely payments, you should disregard the precomputed

January 1 through September 17, 2012.

number of days on line 13 and compute the number of days on each

LINE 7: For each column, add lines 5 and 6 and enter the result

quarter to the date paid.

on line 7.

• If you file your return prior to 1/15/13, enter in the third column

LINE 8: Exception 1 applies if the amount on line 7 of a column

the number of days from 1/1/12 to the date filed and disregard

equals or exceeds the amount on line 8 for the same column. Multiply

the precomputed number of days (15) entered on line 13.

line 2 or 3 (whichever is less) by the percentages shown in each

• The fourth column must be completed by you. Enter the number

column of line 8. If the amount on line 7 (for each column) is equal

of days from 1/15/13 to the date the return was filed and paid.

to or greater than the amount on line 8 (for each column) – no

LINES 14 and 15: Penalty is computed to 12/31/12 at 5%; and

penalty is due and no further entries are required.

at 4% from 1/1/13 to the date the tax was paid, or 4/15/13, whichever

LINE 9: Exception 2 applies if your 2012 tax payments equal or

is earlier.

exceeds 90% (66 2/3% for farmers and fishers) of the tax on your

annualized income for these 2012 periods:

LINE 16: For each column, add lines 14 and 15 and enter the

result on line 16.

January 1 – March 31

Multiply income by 4

January 1 – May 31

Multiply income by 2.4

LINE 17: Add the amounts on line 16 together and enter the result

January 1 – August 31

Multiply income by 1.5

on line 17. Also enter this amount on Form K-40, line 31, Estimated

January 1 – December 31

Multiply income by 1

Tax Penalty.

Page 25

1

1 2

2