Form C-107 - Tax Tables For Succession And Transfer Taxes Page 3

ADVERTISEMENT

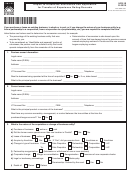

Tax Table for Estates of Decedents Dying During 1998

Class AA. Exempt

Class A. (Total exemption for class ($500,000) is included in table.)

If net taxable amount

but is

the tax is

plus

of the amount

passing to

less than or equal to:

the sum of:

the following %:

exceeding:

Class A is at least:

$0

$500,000

$0

-----

-----

500,000

600,000

0

8.58%

$500,000

600,000

1,000,000

8,580

10.01%

600,000

over 1,000,000

-----

48,620

11.44%

1,000,000

Class B. (Total exemption for class ($6,000) is included in table.)

If net taxable amount

but is

the tax is

plus

of the amount

passing to

less than or equal to:

the sum of:

the following %:

exceeding:

Class B is at least:

$0

$6,000

$0

-----

-----

6,000

25,000

0

5.72%

$6,000

25,000

150,000

1,086.80

7.15%

25,000

150,000

250,000

10,024.30

8.58%

150,000

250,000

400,000

18,604.30

10.01%

250,000

400,000

600,000

33,619.30

11.44%

400,000

600,000

1,000,000

56,499.30

12.87%

600,000

over 1,000,000

-----

107,979.30

14.30%

1,000,000

Class C. (Total exemption for class ($1,000) is included in table.)

If net taxable amount

but is

the tax is

plus

of the amount

passing to

less than or equal to:

the sum of:

the following %:

exceeding:

Class C is at least:

$0

$1,000

$0

-----

-----

1,000

25,000

0

11.44%

$1,000

25,000

150,000

2,745.60

12.87%

25,000

150,000

250,000

18,833.10

14.30%

150,000

250,000

400,000

33,133.10

15.73%

250,000

400,000

600,000

56,728.10

17.16%

400,000

600,000

1,000,000

91,048.10

18.59%

600,000

over 1,000,000

-----

165,408.10

20.02%

1,000,000

C-107 (Rev. 09/05)

Page 3 of 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7