Form C-107 - Tax Tables For Succession And Transfer Taxes Page 7

ADVERTISEMENT

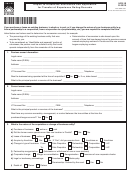

Tax Table for Estates of Decedents Dying On or After March 1, 2003

And Prior To January 1, 2005

Class AA. Exempt

Class A. Exempt

Class B. (Total exemption for class ($600,000) is included in table.)

If net taxable amount

but is

the tax is

plus

of the amount

passing to

less than or equal to:

the sum of:

the following %:

exceeding:

Class B is at least:

$0

$600,000

$0

-----

-----

600,000

1,000,000

0

12.87%

$600,000

over 1,000,000

-----

51,480

14.30%

1,000,000

Class C. (Total exemption for class ($200,000) is included in table.)

If net taxable amount

but is

the tax is

plus

of the amount

passing to

less than or equal to:

the sum of:

the following %:

exceeding:

Class C is at least:

$0

$200,000

$0

-----

-----

200,000

250,000

0

14.30%

$200,000

250,000

400,000

7,150

15.73%

250,000

400,000

600,000

30,745

17.16%

400,000

600,000

1,000,000

65,065

18.59%

600,000

over 1,000,000

-----

139,425

20.02%

1,000,000

Tax Table for Estates of Decedents Dying During 2005

(The succession tax was repealed for estates of decedents dying on or after January 1, 2005.)

Class AA. Exempt

Class A. Exempt

Class B. Exempt

Class C. Exempt

C-107 (Rev. 09/05)

Page 7 of 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7