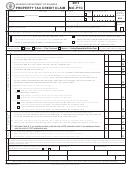

Form Mo-Ptc - Missouri Book Property Tax Credit Claim - 2011

ADVERTISEMENT

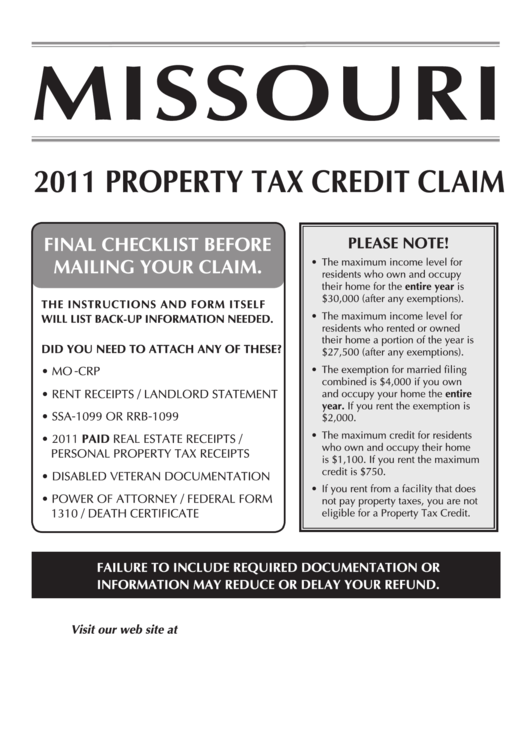

MISSOURI

2011 PROPERTY TAX CREDIT CLAIM

FINAL CHECKLIST BEFORE

PLEASE NOTE!

MAILING YOUR CLAIM.

• The maximum income level for

residents who own and occupy

their home for the entire year is

$30,000 (after any exemptions).

THE INSTRUCTIONS AND FORM ITSELF

• The maximum income level for

WILL LIST BACK-UP INFORMATION NEEDED.

residents who rented or owned

their home a portion of the year is

DID YOU NEED TO ATTACH ANY OF THESE?

$27,500 (after any exemptions).

• The exemption for married filing

• MO - CRP

combined is $4,000 if you own

• RENT RECEIPTS / LANDLORD STATEMENT

and occupy your home the entire

year. If you rent the exemption is

• SSA - 1099 OR RRB - 1099

$2,000.

• The maximum credit for residents

• 2011 PAID REAL ESTATE RECEIPTS /

who own and occupy their home

PERSONAL PROPERTY TAX RECEIPTS

is $1,100. If you rent the maximum

credit is $750.

• DISABLED VETERAN DOCUMENTATION

• If you rent from a facility that does

• POWER OF ATTORNEY / FEDERAL FORM

not pay property taxes, you are not

1310 / DEATH CERTIFICATE

eligible for a Property Tax Credit.

FAILURE TO INCLUDE REQUIRED DOCUMENTATION OR

INFORMATION MAY REDUCE OR DELAY YOUR REFUND.

Visit our web site at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16