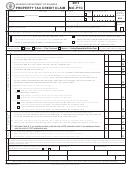

Form Mo-Ptc - Missouri Book Property Tax Credit Claim - 2011 Page 2

ADVERTISEMENT

A

I E

?

m

lIgIblE

Use this diagram to determine if you or your spouse are eligible to claim the

PROPERTY TAX CREDIT (CIRCUIT BREAKER)

START DIAGRAM BY CHOOSING BOX 1 OR BOX 2 AND FOLLOW TO CONCLUSION.

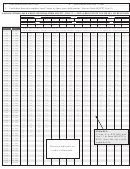

RENTERS / PART YEAR OWNERS -- If single, is your total household income $27,500

NO

1

or less? If married filing combined, is your total household income $29,500 or less? If

you are a 100 percent service connected disabled veteran, do not include VA payments.

YES

OWNED AND OCCUPIED YOUR HOME THE ENTIRE YEAR -- If single, is

NO

2

your total household income $30,000 or less? If married filing

N

OR

combined, is your total household income $34,000 or less? If you are a

O

100 percent service connected disabled veteran, do not include VA payments.

T

YES

E

Did you pay real estate taxes or rent on the home you occupied?

NO

L

RENTERS: If you rent from a facility that does not pay property taxes, you are not eligible for a

I

Property Tax Credit.

G

YES

I

B

NO

Can you truthfully state that you do not employ illegal or unauthorized aliens?

L

YES

E

Were you or your

Were you 60

spouse 65 years

years of age

Are you or your

of age or older

NO

NO

NO

NO

or older as of

spouse 100

Are you or your

as of De c em b er

December 31,

percent disabled

spouse 100

31, 2011, and

2011, and did

as a result of

percent disabled?

were you or your

you receive sur-

military service?

If so, check

spouse a Missouri

viving spouse

Box C on Form

If so, check

resident the entire

social security

Box B on Form

MO-PTC.

2011 calendar

benefits? If so,

MO-PTC.

year? If so, check

check Box D on

Box A on Form

Form MO-PTC.

MO-PTC.

YES

YES

YES

YES

E L I G I B L E

This information is for guidance only and does not state complete law.

2-D Barcode Returns -

If you plan on filing a paper return, you should

consider 2-D barcode filing. The software encodes all your tax information into

a 2-D barcode, which allows your return to be processed in a fraction of the time

it takes to process a traditional paper return. If you use software to prepare your return, check our web site for approved 2-D

barcode software companies. Also, check out the Department’s fill-in forms that calculate and have a 2-D barcode. You can

have your refund direct deposited into your bank account when you use the Department’s fill-in forms. ALL 2-D barcode

returns should be mailed to: Department of Revenue, P.O. Box 3385, Jefferson City, MO 65105-3385.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16