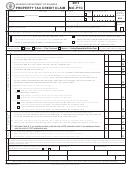

Form Mo-Ptc - Missouri Book Property Tax Credit Claim - 2011 Page 5

ADVERTISEMENT

HOUSEHOLD INCOME

LINE 2 — WAGES, PENSIONS,

ANNUITIES, DIVIDENDS,

Household income is all income received by a

claimant, spouse, and minor children (taxable or

INTEREST, RENTAL INCOME,

nontaxable) and includes all income from sources

OR OTHER INCOME

listed on Lines 1 through 5 of Form MO-PTC.

Include the amount of all wages, pensions, annuities,

LINE 1 — SOCIAL SECURITY

dividends, interest income, rental income, or other

BENEFITS

income. Do not include excludable costs of pensions

or annuities. (These are usually the employee’s contri-

Enter the amount of social security benefits received

bution to a retirement program listed separately on

by you and your minor children before any deduc-

Form 1099-R.) Attach Forms W-2, 1099, 1099-R,

tions and the amount of social security equivalent

1099-DIV, 1099-INT, 1099-MISC, etc. If grants or

railroad retirement benefits. Attach a copy of Forms

long-term care benefits are made payable to the nursing

SSA-1099 and RRB-1099.

facility, do not include as income or rent. If you have

Lump sum distributions from Social Security

any negative income, you cannot use this form.

Administration or other agencies must be claimed in

the year in which they are received.

LINE 3 — RAILROAD RETIREMENT

BENEFITS

Enter the gross distribution amount of railroad retire-

ment benefits (not included in Line 1) before any

deductions. This is the amount of annuities and

pensions received, not your social security equivalent

benefits. Attach Form RRB-1099-R (Tier II).

LINE 4 — VETERAN BENEFITS

Include your veteran payments and benefits. Veteran

payments and benefits include education or training

allowances, disability compensation, grants, and

in s urance proceeds.

Exceptions: If you are 100 percent disabled as a

result of military service, you are not required to

include your veteran payments and benefits. You

must attach a letter from the Veterans Ad min is tra tion

that states you are 100 percent disabled as a result of

military service. To request a copy of the letter, call

the Veterans Administration at (800) 827-1000.

If you are a surviving spouse and your spouse was

100 percent disabled as a result of military service, all

Helpful Hints

the veteran payments and benefits must be included.

•

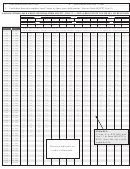

W ait to file your claim until you get your Forms

LINE 5 — PUBLIC ASSISTANCE

SSA-1099. This is not the statement indicating

what your benefits will be, but it is the actual

Include the amount of public assistance, supple-

Form SSA-1099, received in January, 2012, that

mental security income (SSI), child support,

states what your benefits were for the entire 2011

unemployment compensation, and Temporary

year. See the sample Form SSA-1099 above.

Assistance pay m ents received by you and your minor

• I f you are receiving railroad retirement benefits,

children. Temporary Assistance payments include

you should receive two Forms RRB-1099. One

Temporary Assistance for Needy Families (TANF)

Form RRB-1099-R shows annuities and pensions

payments. In Missouri, the program is referred to

and the other is your social security equivalent

as Temporary Assistance (TA). This includes any

railroad retirement benefits. Include the amount

payments received from the government. Do not

from Form RRB-1099 that states social security

include the value of commodity foods, food stamps, or

equivalent (usually Tier I benefits) on Line 1.

heating and cooling assistance.

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16