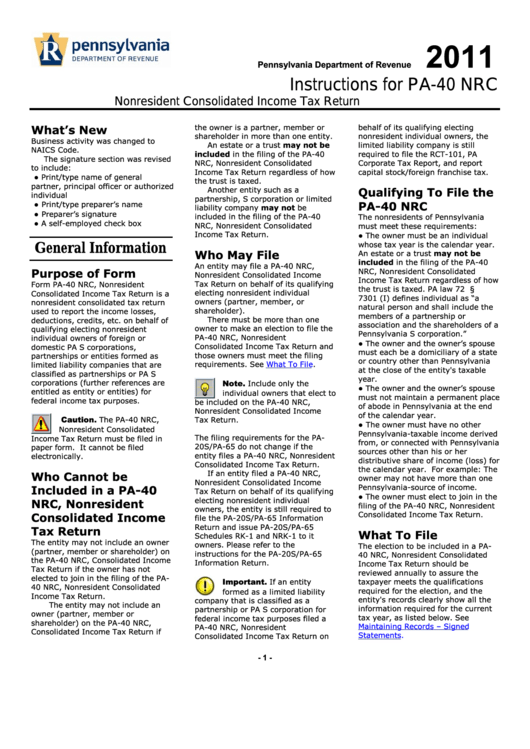

Instructions For Form Pa-40 Nrc - Nonresident Consolidated Income Tax Return - 2011

ADVERTISEMENT

2011

Pennsylvania Department of Revenue

Instructions for PA-40 NRC

Nonresident Consolidated Income Tax Return

the owner is a partner, member or

behalf of its qualifying electing

What’s New

shareholder in more than one entity.

nonresident individual owners, the

Business activity was changed to

An estate or a trust may not be

limited liability company is still

NAICS Code.

included in the filing of the PA-40

required to file the RCT-101, PA

The signature section was revised

NRC, Nonresident Consolidated

Corporate Tax Report, and report

to include:

Income Tax Return regardless of how

capital stock/foreign franchise tax.

●

Print/type name of general

the trust is taxed.

partner, principal officer or authorized

Another entity such as a

Qualifying To File the

individual

partnership, S corporation or limited

PA-40 NRC

●

Print/type preparer’s name

liability company may not be

●

Preparer’s signature

included in the filing of the PA-40

The nonresidents of Pennsylvania

●

A self-employed check box

NRC, Nonresident Consolidated

must meet these requirements:

Income Tax Return.

●

The owner must be an individual

whose tax year is the calendar year.

General Information

Who May File

An estate or a trust may not be

included in the filing of the PA-40

An entity may file a PA-40 NRC,

Purpose of Form

NRC, Nonresident Consolidated

Nonresident Consolidated Income

Income Tax Return regardless of how

Tax Return on behalf of its qualifying

Form PA-40 NRC, Nonresident

the trust is taxed. PA law 72 P.S. §

electing nonresident individual

Consolidated Income Tax Return is a

7301 (I) defines individual as “a

owners (partner, member, or

nonresident consolidated tax return

natural person and shall include the

shareholder).

used to report the income losses,

members of a partnership or

There must be more than one

deductions, credits, etc. on behalf of

association and the shareholders of a

owner to make an election to file the

qualifying electing nonresident

Pennsylvania S corporation.”

PA-40 NRC, Nonresident

individual owners of foreign or

●

The owner and the owner’s spouse

Consolidated Income Tax Return and

domestic PA S corporations,

must each be a domiciliary of a state

those owners must meet the filing

partnerships or entities formed as

or country other than Pennsylvania

requirements. See

What To

File.

limited liability companies that are

at the close of the entity's taxable

classified as partnerships or PA S

year.

Note.

corporations (further references are

Include only the

●

The owner and the owner’s spouse

entitled as entity or entities) for

individual owners that elect to

must not maintain a permanent place

federal income tax purposes.

be included on the PA-40 NRC,

of abode in Pennsylvania at the end

Nonresident Consolidated Income

of the calendar year.

Caution.

The PA-40 NRC,

Tax Return.

●

The owner must have no other

Nonresident Consolidated

Pennsylvania-taxable income derived

The filing requirements for the PA-

Income Tax Return must be filed in

from, or connected with Pennsylvania

20S/PA-65 do not change if the

paper form. It cannot be filed

sources other than his or her

entity files a PA-40 NRC, Nonresident

electronically.

distributive share of income (loss) for

Consolidated Income Tax Return.

the calendar year. For example: The

If an entity filed a PA-40 NRC,

Who Cannot be

owner may not have more than one

Nonresident Consolidated Income

Pennsylvania-source of income.

Included in a PA-40

Tax Return on behalf of its qualifying

●

The owner must elect to join in the

electing nonresident individual

NRC, Nonresident

filing of the PA-40 NRC, Nonresident

owners, the entity is still required to

Consolidated Income Tax Return.

Consolidated Income

file the PA-20S/PA-65 Information

Return and issue PA-20S/PA-65

Tax Return

What To File

Schedules RK-1 and NRK-1 to it

The entity may not include an owner

owners. Please refer to the

The election to be included in a PA-

(partner, member or shareholder) on

instructions for the PA-20S/PA-65

40 NRC, Nonresident Consolidated

the PA-40 NRC, Consolidated Income

Information Return.

Income Tax Return should be

Tax Return if the owner has not

reviewed annually to assure the

elected to join in the filing of the PA-

Important.

If an entity

taxpayer meets the qualifications

40 NRC, Nonresident Consolidated

required for the election, and the

formed as a limited liability

Income Tax Return.

entity's records clearly show all the

company that is classified as a

The entity may not include an

information required for the current

partnership or PA S corporation for

owner (partner, member or

tax year, as listed below. See

federal income tax purposes filed a

shareholder) on the PA-40 NRC,

Maintaining Records – Signed

PA-40 NRC, Nonresident

Consolidated Income Tax Return if

Statements.

Consolidated Income Tax Return on

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6