Form 4589 - Michigan Business Tax Film Credit Assignment - 2012

ADVERTISEMENT

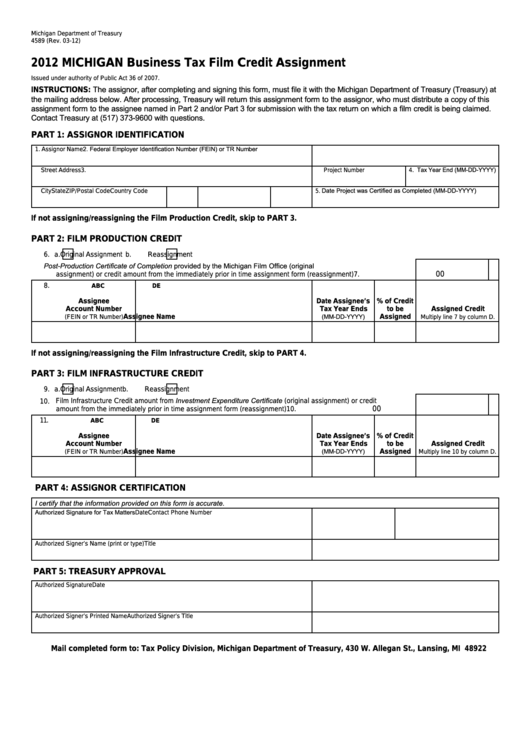

Michigan Department of Treasury

4589 (Rev. 03-12)

2012 MICHIGAN Business Tax Film Credit Assignment

Issued under authority of Public Act 36 of 2007.

INSTRUCTIONS: The assignor, after completing and signing this form, must file it with the Michigan Department of Treasury (Treasury) at

the mailing address below. After processing, Treasury will return this assignment form to the assignor, who must distribute a copy of this

assignment form to the assignee named in Part 2 and/or Part 3 for submission with the tax return on which a film credit is being claimed.

Contact Treasury at (517) 373-9600 with questions.

PART 1: ASSIGNOR IDENTIFICATION

2. Federal Employer Identification Number (FEIN) or TR Number

1. Assignor Name

4. Tax Year End (MM-DD-YYYY)

Street Address

3. Project Number

Country Code 5. Date Project was Certified as Completed (MM-DD-YYYY)

City

State

ZIP/Postal Code

If not assigning/reassigning the Film Production Credit, skip to PART 3.

PART 2: FILM PRODUCTION CREDIT

6. a.

Original Assignment

b.

Reassignment

7. Credit amount from Post-Production Certificate of Completion provided by the Michigan Film Office (original

00

assignment) or credit amount from the immediately prior in time assignment form (reassignment) .....................

7.

8.

A

B

C

D

E

Assignee

Date Assignee’s

% of Credit

Account Number

Tax Year Ends

to be

Assigned Credit

(MM-DD-YYYY)

Assignee Name

Assigned

(FEIN or TR Number)

Multiply line 7 by column D.

If not assigning/reassigning the Film Infrastructure Credit, skip to PART 4.

PART 3: FILM INFRASTRUCTURE CREDIT

9. a.

Original Assignment

b.

Reassignment

10. Film Infrastructure Credit amount from Investment Expenditure Certificate (original assignment) or credit

00

amount from the immediately prior in time assignment form (reassignment) ........................................................

10.

11.

A

B

C

D

E

Assignee

Date Assignee’s

% of Credit

Account Number

Tax Year Ends

to be

Assigned Credit

(MM-DD-YYYY)

Assignee Name

Assigned

(FEIN or TR Number)

Multiply line 10 by column D.

PART 4: ASSIGNOR CERTIFICATION

I certify that the information provided on this form is accurate.

Authorized Signature for Tax Matters

Date

Contact Phone Number

Authorized Signer’s Name (print or type)

Title

PART 5: TREASURY APPROVAL

Authorized Signature

Date

Authorized Signer’s Printed Name

Authorized Signer’s Title

Mail completed form to: Tax Policy Division, Michigan Department of Treasury, 430 W. Allegan St., Lansing, MI 48922

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3