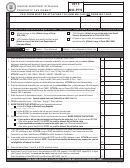

1350

STATE OF SOUTH CAROLINA

SC1040TC

DEPARTMENT OF REVENUE

(Rev. 8/6/13)

SC1040TC Worksheet

3434

Credit for Taxes Paid to Another State

2013

South Carolina Residents/Part Year Residents Only. Complete a separate worksheet for each state. See SC1040TC instructions.

Attach SC1040TC and SC1040TC Worksheet to the SC1040.

Enter name of state. ................................................................................................................................

Dollars

Cents

1 Enter amount of income from line E of worksheet from instructions................................................... 1

00

2 The portion of line 1 above which was taxed by another state.

00

(See line 2 instructions) ..................................................................................................................... 2

3 Percentage. (Divide the amount on line 2 by the amount on line 1, not to exceed 100%.

%

Carry the percentage to the second decimal place.) ......................................................................... 3

4 Amount of South Carolina Tax from SC1040, line 10......................................................................... 4

00

00

5 Tentative credit. (Percentage on line 3 times the amount on line 4.)................................................. 5

6 Net amount of tax calculated as due the other state on the income shown on line 2.

00

(See line 6 instructions) (Do not use withholding amounts from your other state's W-2s.) ....... 6

7 Allowable credit. Enter the lesser of the tax on line 5 or line 6. Also enter this amount on

SC1040TC,line 1. (If more than one worksheet is needed, total all amounts from line 7 of each

00

worksheet enter on SC1040TC, line 1)............................................................................................. 7

SC1040TC Worksheet

Credit for Taxes Paid to Another State

South Carolina Residents/Part Year Residents Only. Complete a separate worksheet for each state. See SC1040TC instructions.

Attach SC1040TC and SC1040TC Worksheet to the SC1040.

Enter name of state. ................................................................................................................................

Dollars

Cents

1 Enter amount of income from line E of worksheet from instructions................................................... 1

00

2 The portion of line 1 above which was taxed by another state.

00

(See line 2 instructions) ..................................................................................................................... 2

3 Percentage. (Divide the amount on line 2 by the amount on line 1, not to exceed 100%.

%

Carry the percentage to the second decimal place.) ......................................................................... 3

4 Amount of South Carolina Tax from SC1040, line 10......................................................................... 4

00

00

5 Tentative credit. (Percentage on line 3 times the amount on line 4.)................................................. 5

6 Net amount of tax calculated as due the other state on the income shown on line 2.

00

(See line 6 instructions) (Do not use withholding amounts from your other state's W-2s.) ....... 6

7 Allowable credit. Enter the lesser of the tax on line 5 or line 6. Also enter this amount on

SC1040TC,line 1. (If more than one worksheet is needed, total all amounts from line 7 of each

00

worksheet enter on SC1040TC, line 1)............................................................................................. 7

34341024

1

1 2

2 3

3 4

4 5

5