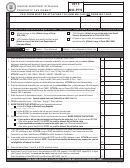

CREDIT DESCRIPTIONS

CREDIT FOR TAXES PAID TO ANOTHER STATE: See SC1040TC worksheet instructions.

CODE TITLE: Description. (Form)

CODE TITLE: Description. (Form)

101 CARRYOVER OF UNUSED QUALIFIED CREDITS: Enter

014 COMMUNITY DEVELOPMENT CREDIT: For investing

the carryover of unused non-refundable credits from prior

amounts not claimed as charitable deductions in qualifying

years. Refer to the particular form applicable to your tax

community

development

corporations

or

financial

credit for the maximum credit and period of time to

institutions. (TC-14)

carryover. Attach a breakdown of the credit by type and

018 RESEARCH EXPENSES CREDIT: For taxpayers claiming

year started.

a federal research expenses credit. (TC-18)

044

EXCESS INSURANCE PREMIUM CREDIT: For excess

020 BROWNFIELDS

CLEANUP

CREDIT:

For

costs

of

premiums paid for property and casualty insurance on a

voluntary cleanup activity by a nonresponsible party under

legal residence. (TC-44)

the Brownfields Voluntary Cleanup Program (TC-20)

004

NEW JOBS CREDIT: For qualifying employers that create

021

CERTIFIED

HISTORIC

STRUCTURE

CREDIT:

For

and maintain 10 or more full-time jobs. (TC-4)

rehabilitation projects that qualify for the federal credit.

QUALIFIED CONSERVATION CONTRIBUTION CREDIT:

(TC-21)

019

For donating a qualifying gift of land for conservation or a

022 CERTIFIED

HISTORIC

RESIDENTIAL

STRUCTURE

qualified conservation contribution of a real property

CREDIT: For qualifying residential rehabilitation projects.

interest. (TC-19)

(TC-22)

001 DRIP/TRICKLE IRRIGATION SYSTEMS CREDIT: For

purchasing and installing conservation tillage equipment,

TEXTILES REHABILITATION CREDIT: For rehabilitating

023

drip/trickle irrigation system, or dual purpose combination

an abandoned textile manufacturing facility. (TC-23)

truck and crane equipment. (TC-1)

024

COMMERCIALS CREDIT: For production companies

002

MINORITY BUSINESS CREDIT: For state contractors that

producing commercials in South Carolina. (TC-24)

subcontract with socially and economically disadvantaged

025 MOTION PICTURES CREDITS AFTER JUNE 30, 2004:

small businesses. (TC-2)

For investing in motion picture projects or motion picture

production or post-production facilities in South Carolina

003

WATER RESOURCES CREDIT: For investing in the

after June 30, 2004. (TC-25)

construction of water storage and control structures for soil

and water conservation, wildlife management, agriculture

026

VENTURE CAPITAL INVESTMENT CREDIT: For lending

and aquaculture purpose. (TC-3)

money to the SC Venture Capital Authority (TC-26)

102

NURSING HOME CREDIT: A credit is allowed for an

027

HEALTH INSURANCE POOL CREDIT: For individuals

individual who pays expenses for his/her own support or

acquiring replacement health insurance coverage through

the support of another to an institution, in any state,

the SC Health Insurance Pool. (TC-27)

providing nursing facility level of care or to a provider for

in-home or community care. A physician must certify that

SC QUALITY FORUM CREDIT: For participating in quality

028

nursing care is needed. No credit is allowed for expenses

programs of the SC Quality Forum. (TC-28)

paid from public source funds (such as Medicaid or

Veterans Administration). The credit is computed by

QUALIFIED

RETIREMENT

PLAN

CONTRIBUTION

029

multiplying the paid expenses by 20% not to exceed a

CREDIT: For taxes paid to another state on qualified

maximum credit of $300.00. No carryover is permitted if

retirement plan contributions not exempt from the other

credit exceeds tax due. There is no separate form for this

state’s income tax. (TC-29)

credit.

PORT CARGO CREDIT: For increasing usage by volume

030

104

SMALL BUSINESS JOBS CREDIT: For qualifying small

at state ports. (TC-30)

businesses that create and maintain 2 or more full-time

jobs. (TC-4SB)

031

RETAIL FACILITIES REVITALIZATION CREDIT: For

revitalizing abandoned retail facilities. (TC-31)

204 ACCELERATED SMALL BUSINESS JOBS CREDIT: For

qualifying small businesses that create 2 or more full-time

032

PREMARITAL PREPARATION COURSE CREDIT: For

jobs. (TC-4SA)

attending a qualifying marriage preparation course prior to

obtaining a SC marriage license. (TC-32)

005 SCENIC RIVERS CREDIT: For donating certain lands

adjacent to designated rivers or sections of a river. (TC-5)

035

ALTERNATIVE

MOTOR

VEHICLE

CREDIT:

For

purchasing qualifying vehicles. (TC-35)

007

PALMETTO SEED CAPITAL CREDIT: For investing in the

Palmetto Seed Capital Corporation. (TC-7)

036

INDUSTRY

PARTNERSHIP

FUND

CREDIT:

For

contributing to the SC Research Authority’s Industry

009

CHILD CARE PROGRAM CREDIT: For employers that

Partnership Fund. (TC-36)

establish child care programs to benefit employees or

donate to a non-profit corporation providing child care

038 SOLAR ENERGY OR SMALL HYDROPOWER SYSTEM

services to employees. (TC-9)

CREDIT: For installing a solar energy system or small

011

CAPITAL INVESTMENT CREDIT: For placing qualifying

hydropower system in a South Carolina facility. (TC-38)

manufacturing and production equipment in service.

(TC-11)

040 ETHANOL OR BIODIESEL PRODUCTION CREDIT: For

producers of corn-based or non-corn-based ethanol or

012

FAMILY INDEPENDENCE PAYMENTS CREDIT: For

soy-based or non-soy-based biodiesel. (TC-40)

employers

hiring

qualifying

recipients

of

Family

Independence Payments. (TC-12)

1

1 2

2 3

3 4

4 5

5