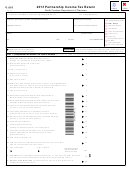

Tax Year

Last Name (First 10 Characters)

Your Social Security Number

Page 3

2013

D-400 Web-Fill

9-13

Be sure to sign and date your return on Page 4.

(See Line Instructions beginning on Page 12.)

Additions to Federal Adjusted Gross Income

Enter Whole U.S. Dollars Only

34. Interest income from obligations of states other than North Carolina

34.

35.

35. Adjustment for bonus depreciation (See instructions on Page 13)

36. Adjustment for section 179 expense deduction (See instructions on Page 13)

36.

37. Adjustment for tuition and fees deduction, Form 1040, Line 34 or Form 1040A, Line 19

37.

(See instructions on Page 13)

38. Other additions to federal adjusted gross income (Attach explanation or schedule)

38.

39. Total additions - Add Lines 34 through 38 (Enter the total here and on Line 7)

39.

Deductions from Federal Adjusted Gross Income

(See Line Instructions beginning on Page 13.)

40. State or local income tax refund if included on Line 10 of Federal Form 1040

40.

41. Interest income from obligations of the United States or United States’ possessions

41.

42. Taxable portion of Social Security and Railroad Retirement Benefits

42.

included on your federal return

Retirement benefits received from vested N.C. State government,

.

43

N.C. local government, or federal government retirees

43.

(Bailey settlement - Important: See Line instructions on Page 14)

44. If you have retirement benefits not reported on Lines 42 or 43, complete the

44.

Retirement Benefits Worksheet on Page 14 and enter the result here

45. Severance wages

45.

(See Line instructions on Page 15 for explanation of qualifying severance wages)

Adjustment for bonus depreciation added back in 2008, 2009, 2010, 2011,

46.

and 2012 (See Line instructions on Page 15)

46a. 2008

46b. 2009

46c. 2010

46d. 2011

46e. 2012

(Add Lines 46a, 46b, 46c, 46d, and 46e and enter on Line 46f.)

46f.

47. Adjustment for section 179 expense deduction added back in 2010, 2011, and 2012 (See Line instructions on Page 15)

47a. 2010

47b. 2011

47c. 2012

(Add Lines 47a, 47b, and 47c and enter on Line 47d.)

47d.

48. Contributions to North Carolina’s National College Savings Program (NC 529 Plan)

48.

(See Line instructions on Page 15 for deduction limitations)

49. Adjustment for absorbed NOL added back in 2003, 2004, 2005, and 2006

49.

(See instructions on Page 15)

Adjustment for net business income that is not considered passive income (See instructions on Page 15)

50.

50.

51.

51. Other deductions from federal adjusted gross income (Attach explanation or schedule.

Do not include any deduction for retirement benefits on this line.)

52.

52. Total deductions - Add Lines 40 through 51 (Enter the total here and on Line 9)

1

1 2

2 3

3 4

4