Form Ct-103 - Unfair Cigarette Sales Act (Ucsa) - Minnesota Department Of Commerce

ADVERTISEMENT

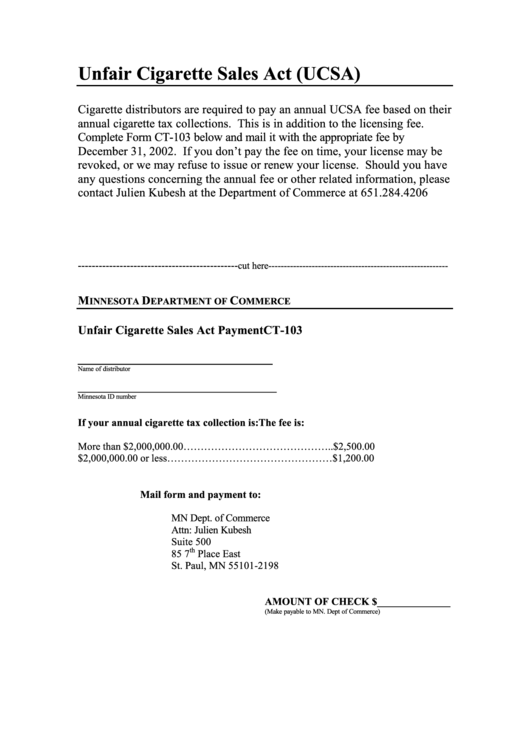

Unfair Cigarette Sales Act (UCSA)

Cigarette distributors are required to pay an annual UCSA fee based on their

annual cigarette tax collections. This is in addition to the licensing fee.

Complete Form CT-103 below and mail it with the appropriate fee by

December 31, 2002. If you don’t pay the fee on time, your license may be

revoked, or we may refuse to issue or renew your license. Should you have

any questions concerning the annual fee or other related information, please

contact Julien Kubesh at the Department of Commerce at 651.284.4206

----------------------------------------------

cut here----------------------------------------------------------

M

D

C

INNESOTA

EPARTMENT OF

OMMERCE

Unfair Cigarette Sales Act Payment

CT-103

________________________________

Name of distributor

______________________________________

Minnesota ID number

If your annual cigarette tax collection is:

The fee is:

More than $2,000,000.00……………………………………..$2,500.00

$2,000,000.00 or less…………………………………………$1,200.00

Mail form and payment to:

MN Dept. of Commerce

Attn: Julien Kubesh

Suite 500

th

85 7

Place East

St. Paul, MN 55101-2198

AMOUNT OF CHECK $______________

(Make payable to MN. Dept of Commerce)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1