General Instructions

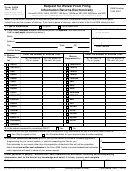

Block 6. –Indicate whether or not this waiver is requested for

corrections only. If you request a waiver for original documents

Paperwork Reduction Act Notice. We ask for the information

and it is approved, you will automatically receive a waiver for

on these forms to carry out the Internal Revenue Laws of the

corrections. However, if you can submit your original returns

United States. You are not required to provide the information

electronically, but not your corrections, a waiver must be

requested on a form that is subject to the Paperwork Reduction

requested for corrections only.

Act unless the form displays a valid OMB control number.

Block 7. –If this is the first time you have requested a waiver for

Books or records relating to a form must be retained as long as

any of the forms listed in Block 5, for any tax year, check “YES”

their contents may become material in the administration of any

and skip to Block 9. However, if you have requested a waiver in

Internal Revenue law. Generally, tax returns and return

the past and check “NO,” complete Block 8 to establish undue

information are confidential, as required by Code section 6103.

hardship. Waivers, after the first year, are granted only in case of

The time needed to provide this information would vary

undue hardship or catastrophic event.

depending on individual circumstances. The estimated average

Note: Under Regulations Section 301.6011-2(c)(2), “The

time is:

principal factor in determining hardship will be the amount, if

Preparing Form 8508 . . . . . . . . . . . . . . . . . . . . . . . . . 15 min.

any, by which the cost of filing the information returns in

accordance with this section exceeds the cost of filing the

If you have comments concerning the accuracy of these time

returns on other media.”

estimates or suggestions for making this form simpler, we

would be happy to hear from you. You can write to the Internal

Block 8. –Enter the cost estimates from two service bureaus or

Revenue Service, Tax Products Coordinating Committee,

other third parties. These cost estimates must reflect the total

SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, IR-6406,

amount that each service bureau will charge for software,

Washington, DC 20224.

software upgrades or programming for your current system, or

DO NOT SEND THE FORMS TO THIS OFFICE. Instead, see

costs to produce your electronic file only. If you do not provide

the instructions below on where to file. When completing this

two written cost estimates from service bureaus or other third

form, please type or print clearly in BLACK ink.

parties, we will automatically deny your request. Cost estimates

from prior years will not be accepted.

Purpose of Form. Use this form to request a waiver from filing

Note: If your request is not due to undue hardship, as

Forms W-2, W-2AS, W-2G, W-2GU, W-2PR, W-2VI, 1042-S,

defined above, attach a detailed explanation of why you

1097-BTC, 1098 Series, 1099 Series, 3921, 3922, 5498 Series,

need a waiver.

or 8027 electronically for the current tax year. Complete a Form

8508 for each Taxpayer Identification Number (TIN). You may

Block 9. –The waiver request must be signed by the payer or a

use one Form 8508 for multiple types of forms. After evaluating

person duly authorized to sign a return or other document on

your request, IRS will notify you as to whether your request is

his behalf.

approved or denied.

Filing Instructions

When to File. – You should file Form 8508 at least 45 days

Specific Instructions

before the due date of the returns for which you are requesting a

waiver. See Publication 1220, Part A for the due dates. Waiver

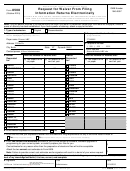

Block 1. –Indicate the type of submission by checking the

requests will be processed beginning January 1st of the calendar

appropriate box. An original submission is your first request for

year the returns are due.

a waiver for the current year. A reconsideration indicates that

Where to File –

you are submitting additional information to IRS that you feel

By Mail:

Internal Revenue Service

may reverse a denial of an originally submitted request.

Information Returns Branch

Block 2. –Enter the name and complete address of the payer

Attn: Extension of Time Coordinator

and person to contact if additional information is needed by IRS.

240 Murall Drive Mail Stop 4360

Kearneysville, WV 25430

Block 3. –Enter the Taxpayer Identification Number (TIN)

[Employer Identification Number (EIN) or the Social Security

By Fax:

1-877-477-0572

Number (SSN)] of the payer. The number must contain 9-digits.

Please either fax or mail, do not do both.

Block 4. –Enter the telephone number and Email address of

For further information concerning the filing of information

the contact person.

returns to IRS electronically, contact the IRS Enterprise

Block 5. –Check the box(es) beside the form(s) for which the

Computing Center at the address above or by telephone at

waiver is being requested.

866-455-7438 between 8:30 a.m. and 4:30 p.m. Eastern

Standard Time.

Block 5a. –For each type of information return checked, enter

Penalty. – If you are required to file electronically but fail to do

the total number of forms you plan to file.

so and you do not have an approved waiver on record, you may

Block 5b. –Provide an estimate of the total number of

be subject to a penalty of $100 per return unless you establish

information returns you plan to file for the following tax year.

reasonable cause.

8508

Catalog Number 63499V

Form

(Rev. 1-2012)

1

1 2

2