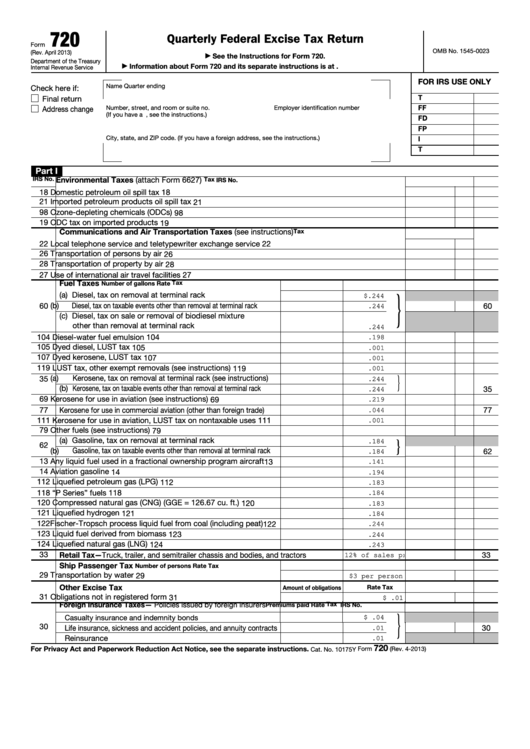

720

Quarterly Federal Excise Tax Return

Form

OMB No. 1545-0023

(Rev. April 2013)

See the Instructions for Form 720.

▶

Department of the Treasury

Information about Form 720 and its separate instructions is at

▶

Internal Revenue Service

FOR IRS USE ONLY

Name

Quarter ending

Check here if:

T

Final return

FF

Number, street, and room or suite no.

Employer identification number

Address change

(If you have a P.O. box, see the instructions.)

FD

FP

City, state, and ZIP code. (If you have a foreign address, see the instructions.)

I

T

Part I

Environmental Taxes (attach Form 6627)

IRS No.

Tax

IRS No.

18

Domestic petroleum oil spill tax

18

21

Imported petroleum products oil spill tax

21

98

Ozone-depleting chemicals (ODCs)

98

19

ODC tax on imported products

19

Communications and Air Transportation Taxes (see instructions)

Tax

22

Local telephone service and teletypewriter exchange service

22

26

Transportation of persons by air

26

28

Transportation of property by air

28

27

Use of international air travel facilities

27

Fuel Taxes

Tax

Number of gallons

Rate

}

(a) Diesel, tax on removal at terminal rack

$.244

60

(b) Diesel, tax on taxable events other than removal at terminal rack

60

.244

(c) Diesel, tax on sale or removal of biodiesel mixture

other than removal at terminal rack

.244

104

Diesel-water fuel emulsion

104

.198

105

Dyed diesel, LUST tax

105

.001

107

Dyed kerosene, LUST tax

107

.001

119

LUST tax, other exempt removals (see instructions)

119

.001

}

(a) Kerosene, tax on removal at terminal rack (see instructions)

35

.244

(b) Kerosene, tax on taxable events other than removal at terminal rack

35

.244

69

Kerosene for use in aviation (see instructions)

69

.219

77

Kerosene for use in commercial aviation (other than foreign trade)

77

.044

111

Kerosene for use in aviation, LUST tax on nontaxable uses

111

.001

79

Other fuels (see instructions)

79

(a) Gasoline, tax on removal at terminal rack

}

.184

62

(b) Gasoline, tax on taxable events other than removal at terminal rack

62

.184

13

Any liquid fuel used in a fractional ownership program aircraft

13

.141

14

Aviation gasoline

14

.194

112

Liquefied petroleum gas (LPG)

112

.183

118

“P Series” fuels

118

.184

120

Compressed natural gas (CNG) (GGE = 126.67 cu. ft.)

120

.183

121

Liquefied hydrogen

121

.184

122

Fischer-Tropsch process liquid fuel from coal (including peat)

122

.244

123

Liquid fuel derived from biomass

123

.244

124

Liquefied natural gas (LNG)

124

.243

33

Retail Tax—Truck, trailer, and semitrailer chassis and bodies, and tractors

33

12% of sales price

Ship Passenger Tax

Number of persons

Rate

Tax

29

Transportation by water

29

$3 per person

Other Excise Tax

Amount of obligations

Rate

Tax

31

Obligations not in registered form

31

$ .01

Foreign Insurance Taxes— Policies issued by foreign insurers

Tax

Premiums paid

Rate

IRS No.

}

Casualty insurance and indemnity bonds

$ .04

30

Life insurance, sickness and accident policies, and annuity contracts

30

.01

Reinsurance

.01

720

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

Form

(Rev. 4-2013)

Cat. No. 10175Y

1

1 2

2 3

3 4

4 5

5 6

6 7

7