Form Wv/nrer - Application For Early Refund Of Withholding On Sales Of Real Property By Nonresidents Page 2

ADVERTISEMENT

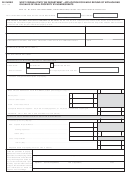

WV/NRER

INSTRUCTIONS FOR APPLICATION FOR EARLY REFUND OF WITHHOLDING ON SALES OF REAL

PROPERTY BY NONRESIDENTS

the amount from Line d on Line 3. Purchase price and improvement docu-

GENERAL INSTRUCTIONS

mentation will be required.

THIS FORM IS OPTIONAL AND IS NOT REQURIED TO BE FILED.

Line 4. Subtract the amount on Line 3 from the amount on Line 2. However,

PURPOSE OF FORM

if you are reporting a gain under the installment method for federal income

tax purposes, attach a separate sheet that lists the payments received

The income tax withheld at closing and paid to the WV State Tax Depart-

during the tax year and the gross profit percentage. Multiply the amount of

ment is claimed on the WV Income Tax return filed by transferor for the tax

the payments by the gross profit percentage and enter the result on Line 4.

year in which the transfer of the real property and associated tangible

personal property in WV is sold. You may elect to receive a refund of

Line 5. Complete whichever applies: 2.5% of total payment or 6.5% of

excess income tax withheld prior to filing the income tax return. Use form

estimated capital gain.

WV/NRER to apply for a refund of the amount of tax withheld on the sale or

transfer of WV real property interest(s) by a nonresident individual or

Line 6. Subtract the amount on Line 5 from the amount on Line 1. If an

nonresident entity which is in excess of the transferor/seller’s tax liability

overpayment is shown on Line 6, the State Tax Department will refund any

for the transaction. Form WV/NRER may not be filed prior to 60 days after

amount of $2.00 or more.

the date the tax withheld is paid to the State Tax Department and may not be

filed more than 120 days after the date of transfer of the real property.

SIGNATURE(S):

Form WV/NRER may not be filed after the end of the tax year in which the

transfer of the real property occurs. Form WV/NRER will be rejected if it is

Form WV/NRER must be signed by an individual (both taxpayer and spouse,

filed after the end of the tax year in which the transfer occurs.

if filing a joint income tax return), or a responsible officer of the company or

corporation.

IMPORTANT: If Form WV/NRER is filed, the transferor/seller must still file

the appropriate WV Income Tax return after the end of the tax year, report

Your signature(s) signifies that your application, including all attachments,

the entire income for the year (from all sources, including the transfer), and

is, to the best of your knowledge and belief, true, correct and complete,

pay any additional tax due on the income or request an additional refund.

under the penalties of perjury.

If a power of attorney is necessary, complete WV Form 2848 and attach to

WHO MAY FILE AN APPLICATION

your applicaiton.

An individual, fiduciary, or corporation transferor/seller may file Form WV/

WHERE TO FILE

NRER. A pass-through entity transferor/seller may not file Form WV/NRER.

File the completed WV/NRER with the:

NOTE: Generally, any claim for refund or credit for overpayment of taxes

must be filed within three years from the date the return is filed or within

WV STATE TAX DEPARTMENT

two years from the date the tax is paid, whichever is later.

IAD/WITHHOLDING

PO BOX 784

CHARLESTON WV 25323-0784

SPECIFIC INSTRUCTIONS

ADDITIONAL INFORMATION

At the top of Form WV/NRER, enter the tax year of the transferor/seller if

other than a calendar year.

For additional information, please call:

Enter the name, address and identification number (social security number

1-800-982-8297 or

or federal employer identification number) of the transferor/seller applying

TDD (hearing impaired) 1-800-282-9833

for a refund of the amount withheld. The name and identification number

entered must be the same as the name and identification number entered

for the transferor/seller on the Form WV/NRSR. If the identification number

on this form is incorrect, enter the correct identification number and attach

an explanation to the form. If the transferor/seller was issued an individual

taxpayer identification number (ITIN) by the IRS, enter the ITIN.

Line A. Enter the date of the transfer.

Line B. Enter the location and general description of the property, including

the WV property account ID number assigned by the County Assessor.

Check the box applicable to the type of taxpayer.

Line C. Enter the information describing the WV real property transaction.

Line 1. Enter the amount of tax withheld and reported on Line 8i of the Form

WV/NRSR. A photocopy of Copy B of the form must be attached to this

form. Retain the original Copy B with your tax records.

Line 2. Enter the gross sales price from the sale. Attach a copy of the HUD-

1 closing statement from the sale of this property.

Line 3. In general, the cost or adjusted basis is the cost of the property plus

purchase commissions and improvements, minus depreciation (if appli-

cable). Increase the cost or other basis by any expense of sale, such as

commissions and state transfer taxes. Complete the Schedule for Compu-

tation of Cost or Other Bases on the bottom of Form WV/NRER and enter

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2