Form 06-05-04 Instructions

ADVERTISEMENT

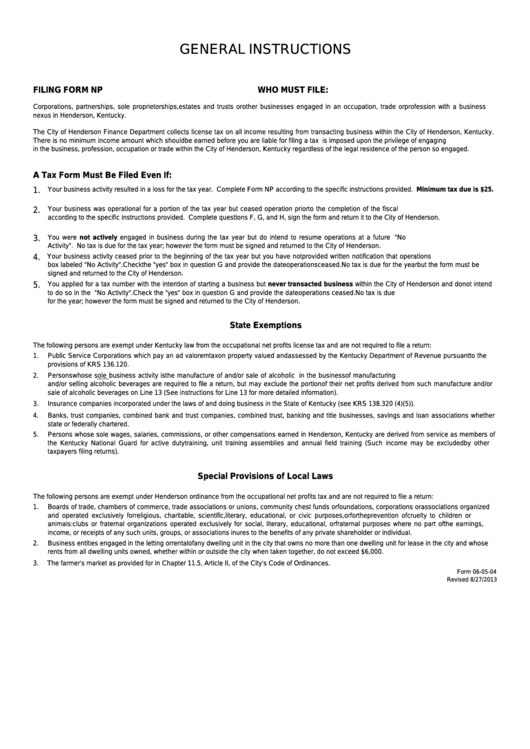

GENERAL INSTRUCTIONS

FILING FORM NP

WHO MUST FILE:

Corporations, partnerships, sole proprietorships, estates and trusts or other businesses engaged in an occupation, trade or profession with a business

nexus in Henderson, Kentucky.

The City of Henderson Finance Department collects license tax on all income resulting from transacting business within the City of Henderson, Kentucky.

There is no minimum income amount which should be earned before you are liable for filing a tax return. The tax is imposed upon the privilege of engaging

in the business, profession, occupation or trade within the City of Henderson, Kentucky regardless of the legal residence of the person so engaged.

A Tax Form Must Be Filed Even If:

1.

Your business activity resulted in a loss for the tax year. Complete Form NP according to the specific instructions provided. Minimum tax due is $25.

Your business was operational for a portion of the tax year but ceased operation prior to the completion of the fiscal period. Complete the tax form

2.

according to the specific instructions provided. Complete questions F, G, and H, sign the form and return it to the City of Henderson.

You were not actively engaged in business during the tax year but do intend to resume operations at a future date. Check the box labeled "No

3.

Activity". No tax is due for the tax year; however the form must be signed and returned to the City of Henderson.

4.

Your business activity ceased prior to the beginning of the tax year but you have not provided written notification that operations ceased. Check the

box labeled "No Activity". Check the "yes" box in question G and provide the date operations ceased. No tax is due for the year but the form must be

signed and returned to the City of Henderson.

5.

You applied for a tax number with the intention of starting a business but never transacted business within the City of Henderson and do not intend

to do so in the future. Check the box labeled "No Activity". Check the "yes" box in question G and provide the date operations ceased. No tax is due

for the year; however the form must be signed and returned to the City of Henderson.

State Exemptions

The following persons are exempt under Kentucky law from the occupational net profits license tax and are not required to file a return:

1.

Public Service Corporations which pay an ad valorem tax on property valued and assessed by the Kentucky Department of Revenue pursuant to the

provisions of KRS 136.120.

Persons whose sole business activity is the manufacture of and/or sale of alcoholic beverages. Persons engaged in the business of manufacturing

2.

and/or selling alcoholic beverages are required to file a return, but may exclude the portion of their net profits derived from such manufacture and/or

sale of alcoholic beverages on Line 13 (See instructions for Line 13 for more detailed information).

3.

Insurance companies incorporated under the laws of and doing business in the State of Kentucky (see KRS 138.320 (4)(5)).

4.

Banks, trust companies, combined bank and trust companies, combined trust, banking and title businesses, savings and loan associations whether

state or federally chartered.

5.

Persons whose sole wages, salaries, commissions, or other compensations earned in Henderson, Kentucky are derived from service as members of

the Kentucky National Guard for active duty training, unit training assemblies and annual field training (Such income may be excluded by other

taxpayers filing returns).

Special Provisions of Local Laws

The following persons are exempt under Henderson ordinance from the occupational net profits tax and are not required to file a return:

1.

Boards of trade, chambers of commerce, trade associations or unions, community chest funds or foundations, corporations or associations organized

and operated exclusively for religious, charitable, scientific, literary, educational, or civic purposes, or for the prevention of cruelty to children or

animals: clubs or fraternal organizations operated exclusively for social, literary, educational, or fraternal purposes where no part of the earnings,

income, or receipts of any such units, groups, or associations inures to the benefits of any private shareholder or individual.

2.

Business entities engaged in the letting or rental of any dwelling unit in the city that owns no more than one dwelling unit for lease in the city and whose

rents from all dwelling units owned, whether within or outside the city when taken together, do not exceed $6,000.

3.

The farmer's market as provided for in Chapter 11.5, Article II, of the City's Code of Ordinances.

Form 06-05-04

Revised 8/27/2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4