“Nonbusiness income” means all income other than

that installment gains be apportioned to Oregon using

the average percent from the year of the sale rather than

business income. Rents, royalties, gains or losses, and

the year payment is received.

interest also can be nonbusiness income if they arise

from investments not related to the taxpayer’s business.

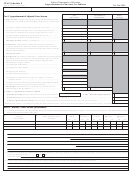

Line 8. Add: Gains from prior year installment sales

Nonbusiness income is allocated to a particular state

apportioned to Oregon. Multiply the installment gains

based upon the source of the income. Gain or loss from

subtracted on line 3 by the average percent from the year

the sale of a partnership interest may be allocable to Ore-

of the sale.

gon [ORS 314.635(4)]. The amounts allocable to Oregon

Line 10. Net loss and net capital loss deduction. Do not

must be added to Oregon’s apportioned income. See ORS

use line 10 when computing Oregon-source distributive

314.610 and administrative rules.

income for nonresident owners of PTEs.

For nonbusiness income (loss) you must include a

Note: If you are claiming the Oregon investment advan-

schedule that clearly states:

tage subtraction allowed under ORS 317.391, include the

• Nature and source for each nonbusiness item and the

amount of exempt certified facility income on line 10b.

corresponding dollar amount.

Attach a schedule showing your computations.

• Separate computation showing how you figured each

Line 11. Carry this amount to the appropriate line on

item.

your tax return: Form 20, line 15; Form 20-I, line 16; Form

• Reasons the income, loss, expenses, or deductions are

20-S, line 6; or Form 20-INS, line 21. For nonresident

being allocated.

owners of PTEs, this line results in Oregon-source dis-

• Description of property with name and FEIN (if appli-

tributive income. Report each nonresident owner’s and

cable), including any schedules and statements used

corporate owner’s share on their information return,

for federal reporting purposes.

along with the Oregon-source portion of (1) any guar-

Line 3. Subtract: Gains from prior year installment

anteed payments (for partnerships) and (2) the taxable

sales included in line 1. OAR 150-314.615-(G) requires

portion of distributions.

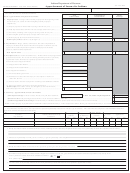

AP Worksheets (Oregon apportionment percentage)

These worksheets are for businesses having business activities both inside and outside of Oregon. If the entity’s

business activities are all within Oregon, do not use these worksheets.

Standard apportionment worksheet

Business income is apportioned to Oregon by multiplying the income by a multiplier equal to Oregon sales and other receipts

as determined by Schedule AP-1, divided by total sales and other receipts from the federal return. See ORS 314.650.

(a)

(b)

(c) = (a ÷ b) x 100

1. Total sales and other receipts (Schedule AP-1, line 21) ....................................... 1

2. Oregon apportionment percentage (enter on Schedule AP-1, line 22) ............................................................................. 2

%

Alternative apportionment worksheet

(double-weighted sales factor formula) for utility or telecommunications

taxpayers

Taxpayers primarily engaged in utilities or telecommunications may elect to apportion business income using the double-

weighted sales factor provided in ORS 314.650 (1999 edition).

Check the box on front of your return if you’re using the alternative apportionment worksheet (Form 20, question M; Form

20-I, question L; Form 20-S, question J). All others use the standard apportionment worksheet above.

(a)

(b)

(c) = (a ÷ b) x 100

%

1. Total owned and rented property (Schedule AP-1, line 9) ................................... 1

%

2. Total wages and salaries (Schedule AP-1, line 12) .............................................. 2

%

3. Total sales and other receipts (Schedule AP-1, line 21) ....................................... 3

%

4. Total sales and other receipts (same as line 3 above).......................................... 4

%

5. Total percent (add lines 1-4, column c above) ...................................................................................................................... 5

6. Number of factors with a positive number in column b ........................................................................................................ 6

%

7. Alternative apportionment percentage (divide line 5 by line 6; enter on Schedule AP-1, line 22) .................................... 7

3

150-102-171 (Rev. 10-12)

Schedule AP instructions

1

1 2

2 3

3 4

4