:

(If applicable)

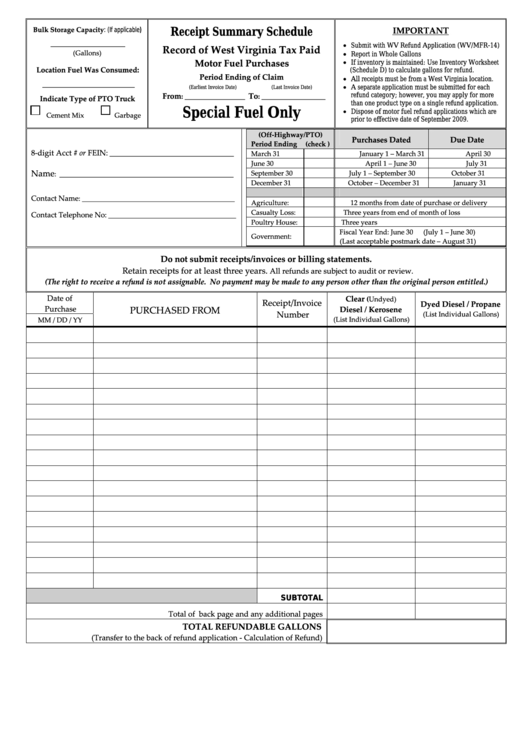

Bulk Storage Capacity

Receipt Summary Schedule

IMPORTANT

_____________________

• Submit with WV Refund Application (WV/MFR-14)

Record of West Virginia Tax Paid

• Report in Whole Gallons

(Gallons)

• If inventory is maintained: Use Inventory Worksheet

Motor Fuel Purchases

:

Location Fuel Was Consumed

(Schedule D) to calculate gallons for refund.

Period Ending of Claim

• All receipts must be from a West Virginia location.

__________________________

• A separate application must be submitted for each

(Earliest Invoice Date)

(Last Invoice Date)

From

To

refund category; however, you may apply for more

: _________________

: __________________

Indicate Type of PTO Truck

than one product type on a single refund application.

Special Fuel Only

• Dispose of motor fuel refund applications which are

Cement Mix Garbage

prior to effective date of September 2009.

(Off‐Highway/PTO)

Purchases Dated

Due Date

Period Ending (check )

8‐digit Acct # or FEIN:

___________________________________

March 31

January 1 – March 31

April 30

June 30

April 1 – June 30

July 31

Name

September 30

July 1 – September 30

October 31

: _________________________________________________

December 31

October – December 31

January 31

Contact Name

: ___________________________________________

Agriculture:

12 months from date of purchase or delivery

Casualty Loss:

Three years from end of month of loss

Contact Telephone No:

____________________________________

Poultry House:

Three years

Fiscal Year End: June 30 (July 1 – June 30)

Government:

(Last acceptable postmark date – August 31)

Do not submit receipts/invoices or billing statements.

Retain receipts for at least three years.

All refunds are subject to audit or review.

(The right to receive a refund is not assignable. No payment may be made to any person other than the original person entitled.)

Date of

Clear

(Undyed)

Receipt/Invoice

Dyed Diesel / Propane

Purchase

PURCHASED FROM

Diesel / Kerosene

Number

(List Individual Gallons)

(List Individual Gallons)

MM / DD / YY

SUBTOTAL

Total of back page and any additional pages

TOTAL REFUNDABLE GALLONS

(Transfer to the back of refund application ‐ Calculation of Refund)

1

1 2

2