Form Ab-130 Sample And Instructions - Wisconsin Distilled Spirits, Cider, And Wine Tax Return Page 2

ADVERTISEMENT

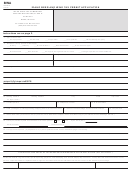

AB-130 Wisconsin Distilled Spirits, Cider, and Wine Tax Return

(Attach Schedules AB-131, AB-135 or AB-138 to Your Monthly Return)

Legal Name

Tax Account Number

PERMIT CANCELLATION

DBA

Period (MM YYYY)

Cancel my permit effective

State

Address

City

Zip

(MM DD YYYY)

SPIRITS LITERS

WINE LITERS

WINE LITERS

APPLE CIDER

SECTION 1

–

SECTION 3

– TAX COMPUTATION

(over 14% but not

LITERS

(over 1/2%)

(14% or less)

SUMMARY OF UNTAXED PRODUCTS

over 21%)

(7% or less)

Complete Sections 1 and 2 and then enter the

1. Physical Inventory Beginning of Month

liters from those sections on lines 24 and 25 below.

1

(from last month’s AB-130, line 13)

Multiply by tax rates shown.

2. Purchases

2

(from Schedule 1, Untaxed Purchases)

IN-STATE PERMITTEES

3. Bottled

3

– Enter liters from line 12 less line 18.

4. Released from Bonded Premises

4

(from AB-138, line 9A)

OUT-OF-STATE PERMITTEES

– Enter liters from line 19.

5. TOTAL

(add lines 1 through 4)

5

6. Sales Out-of-State

6

(from Schedule 5, Untaxed Sales)

24a.

X $ .8586 =

7. Sales in Wisconsin

7

tax rate

spirit liters

(from Schedule 5, Untaxed Sales)

8. Credits

24b.

X $ .02906 =

8

(from Schedule 3, Untaxed Credits)

adm. fee

spirit liters

9. Department Authorized Entries

9

25a.

X $ .06605 =

10. TOTAL EXEMPTIONS

(add lines 6 through 9)

liters - wine 14% or less

10

11. Net

25b.

X $ .1189 =

(line 5 less line 10)

11

liters - wine over 14%

12. Transferred to Tax-Paid Status

(to line 16 below)

12

25c.

X $ .0171 =

13. Physical Inventory End of Month

liters - apple cider 7% or less

13

SECTION 2

– SUMMARY OF TAX-PAID PRODUCTS

LITERS

LITERS

LITERS

LITERS

26. TOTAL AMOUNT DUE

14. Physical Inventory Beginning of Month

Add lines 24a through 25c

14

(from last month’s AB-130, line 23)

15. Purchases

15

(from Schedule 2, Tax-Paid Purchases)

16. Transferred from Untaxed Status

16

(from line 12 above)

17. TOTAL

17

(add lines 14, 15, and 16)

18. Sales Out-of-State

18

I declare under penalties of law that I have examined

(from Schedule 6, Tax-Paid Sales)

this return and to the best of my knowledge and

19. Sales in Wisconsin

19

belief, it is true, correct and complete.

(from Schedule 6, Tax-Paid Sales)

Signature

20. Credits

20

(from Schedule 4, Tax-Paid Credits)

21. Inventory Discrepancies – (over) short

21

(line 22 minus lines 18, 19, and 20)

Title

Date

22. TOTAL DISPOSITIONS

(line 17 less line 23)

22

Business Telephone

23. Physical Inventory End of Month

(

)

23

- 2 -

AB-130 (R. 11-13)

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2