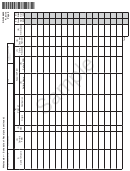

00007

❑

DR-309632

Check here if

schedule

R. 01/14

Page 13

Schedule 12 — Ultimate vendor credits worksheet for reporting deliveries and exports of tax paid fuel

to consumers who qualify to purchase fuel tax-exempt

Schedule

Company Name

FEIN

Collection Period Ending

GALLONS

DIESEL

A. Gasoline

B. Undyed

C. Dyed

D. Aviation

1.

Total gallons delivered to other tax exempt

entities (Schedule 10): .........................................

2.

Total gallons delivered to U.S. Government tax

exempt - 500 gallons or more (Schedule 8): .......

3.

Total gallons exported by other than

bulk transfer: (Schedule 7A): ...............................

4.

Total gallons tax paid aviation fuel converted for

highway use (Schedule 5HW): ............................

5.

Total gallons qualifying for credit:

(Add Lines 1,2,3, and 4) ......................................

.28525

.173

.069

State fuel tax rate: .............................................

6.

7.

State tax due: (Line 5 times Line 6) .....................

.00314

.0067

.002

8.

Collection allowance rates for state tax: ...........

9.

State tax collection allowance

calculation: (Line 7 times Line 8) .........................

10. Local option rate entitled to collection

.07

allowance: ...........................................................

11. Portion of local option tax entitled to collection

allowance: (Line 5, Column B times Line 10) ......

.011

12. Local option collection allowance rate: ...............

13. Local option collection allowance

calculation: (Line 11 times Line 12) .....................

14. Local option tax rate not entitled to

.073

collection allowance: ...........................................

15. Portion of local option tax not entitled to collection

allowance: (Line 5, Column B times Line 14) .......

16. Ultimate vendor credit calculation:

A. Gasoline: (Line 7 minus Line 9) .......................

B. Diesel: (Line 7 minus Line 9 plus Line 11

minus Line 13 plus Line 15) ............................

C. Aviation: (Line 7 minus Line 9) ........................

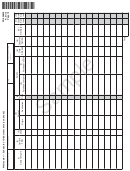

Shared Collection Allowance Add-back

17. Enter the amount from Line 5 above (total gallons

qualifying for credit): If zero, skip to Line 24 .......

18. Enter the amount from Line 7, Page 4 of this

return (net taxable gallons): .................................

19. Gallons subject to shared collection allowance

calculation: (Line 17 minus 18). If negative, enter

zero and skip to Line 24 ......................................

.28525

.173

.069

20. State fuel tax rate: ...............................................

21. Tax subject to shared collection allowance:

(Line 19 times Line 20) ........................................

.001

.00157

.00335

22. Shared collection allowance add-back rates: .....

23. Shared collection allowance add-back:

(Line 21 times Line 22) .........................................

24. Allowable ultimate vendor credit

A. Gasoline: (Line 16A plus Line 23A) .................

B. Diesel: (Line 16B plus Line 23B) .....................

C. Aviation: (Line 16C plus Line 23C) ..................

25. Total ultimate vendor credit amount: (Add Line 24A, Line 24B, and Line 24C. Carry forward to Page 3, Line 25.) . .......

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14