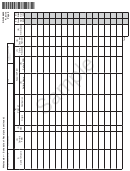

00003

DR-309632

R. 01/14

Page 5

Company Name

FEIN

Collection Period Ending

Enter the total gallons from each receipt and disbursement schedule on this page. Report receipts and disbursements in

whole net gallons

GALLONS

DIESEL

From

A. Gasoline

D. Aviation

B. Undyed

C. Dyed

Schedule

Section I - Receipts: (see instructions)

1A

1.

Gallons received - Florida tax paid: ..........

2.

Gallons received from supplier for export -

1B

other state’s tax paid: ................................

3.

Gallons received - tax unpaid

2A

(imports): ...................................................

4.

Total product received or blended - Florida

2B

tax unpaid: ................................................

5.

Taxable receipts: (Line 3 plus Line 4. Carry

to Page 4, Line 7.) .....................................

6.

Total receipts: (Carry to Page 4,

Line 2.) .......................................................

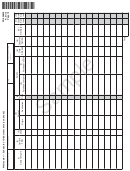

DIESEL

A. Gasoline

D. Aviation

From

B. Undyed

C. Dyed

Schedule

Section II - Disbursements: (see instructions)

1.

Gallons gasoline delivered - all taxes

5LO

collected (state and local option taxes): ...

2.

Gallons diesel delivered - all taxes

5A

collected (state & local option taxes): .......

3.

Gallons delivered - Florida state

5B

tax only collected: .....................................

4.

Gallons aviation converted for

5HW

highway use: .............................................

5.

Gallons exported by other than

7A

bulk transfer: .............................................

6.

Gallons exported - other state’s tax

7B

paid to supplier: ........................................

7.

Gallons delivered To U.S. Government

8

(500 gallons or more): ................................

8.

Gallons of undyed diesel, jet fuel or

10

aviation gasoline delivered to other tax

exempt entities: .........................................

9.

Total disbursements:

(Add Lines 1 through 8. Carry to Page 4,

Line 3.) .......................................................

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14