Form Dr-534 - Notice And Application For Alternative Payment Of 20 - Property Taxes

ADVERTISEMENT

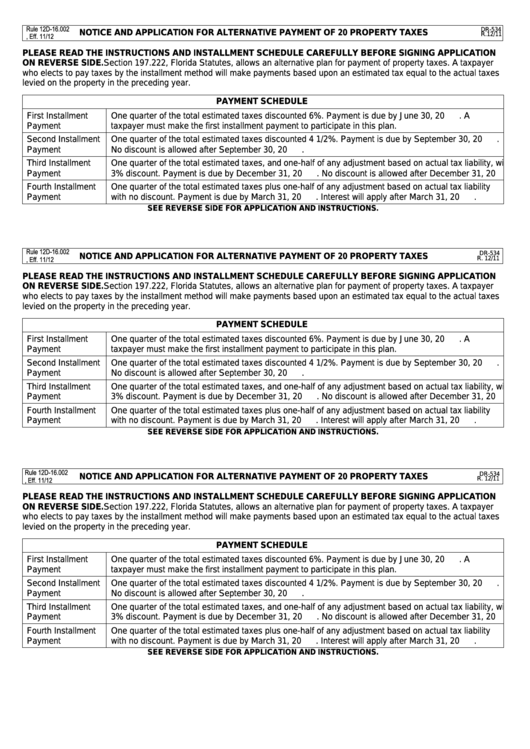

Rule 12D-16.002

DR-534

NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF 20

PROPERTY TAXES

F.A.C., Eff. 11/12

R.12/11

PLEASE READ THE INSTRUCTIONS AND INSTALLMENT SCHEDULE CAREFULLY BEFORE SIGNING APPLICATION

ON REVERSE SIDE. Section 197.222, Florida Statutes, allows an alternative plan for payment of property taxes. A taxpayer

who elects to pay taxes by the installment method will make payments based upon an estimated tax equal to the actual taxes

levied on the property in the preceding year.

PAYMENT SCHEDULE

First Installment

One quarter of the total estimated taxes discounted 6%. Payment is due by June 30, 20

. A

Payment

taxpayer must make the first installment payment to participate in this plan.

Second Installment

One quarter of the total estimated taxes discounted 4 1/2%. Payment is due by September 30, 20

.

Payment

No discount is allowed after September 30, 20

.

Third Installment

One quarter of the total estimated taxes, and one-half of any adjustment based on actual tax liability, with a

Payment

3% discount. Payment is due by December 31, 20

. No discount is allowed after December 31, 20

.

Fourth Installment

One quarter of the total estimated taxes plus one-half of any adjustment based on actual tax liability

Payment

with no discount. Payment is due by March 31, 20

. Interest will apply after March 31, 20

.

SEE REVERSE SIDE FOR APPLICATION AND INSTRUCTIONS.

Rule 12D-16.002

DR-534

NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF 20

PROPERTY TAXES

F.A.C., Eff. 11/12

R. 12/11

PLEASE READ THE INSTRUCTIONS AND INSTALLMENT SCHEDULE CAREFULLY BEFORE SIGNING APPLICATION

ON REVERSE SIDE. Section 197.222, Florida Statutes, allows an alternative plan for payment of property taxes. A taxpayer

who elects to pay taxes by the installment method will make payments based upon an estimated tax equal to the actual taxes

levied on the property in the preceding year.

PAYMENT SCHEDULE

First Installment

One quarter of the total estimated taxes discounted 6%. Payment is due by June 30, 20

. A

Payment

taxpayer must make the first installment payment to participate in this plan.

Second Installment

One quarter of the total estimated taxes discounted 4 1/2%. Payment is due by September 30, 20

.

Payment

No discount is allowed after September 30, 20

.

Third Installment

One quarter of the total estimated taxes, and one-half of any adjustment based on actual tax liability, with a

Payment

3% discount. Payment is due by December 31, 20

. No discount is allowed after December 31, 20

.

Fourth Installment

One quarter of the total estimated taxes plus one-half of any adjustment based on actual tax liability

Payment

with no discount. Payment is due by March 31, 20

. Interest will apply after March 31, 20

.

SEE REVERSE SIDE FOR APPLICATION AND INSTRUCTIONS.

Rule 12D-16.002

DR-534

NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF 20

PROPERTY TAXES

F.A.C., Eff. 11/12

R. 12/11

PLEASE READ THE INSTRUCTIONS AND INSTALLMENT SCHEDULE CAREFULLY BEFORE SIGNING APPLICATION

ON REVERSE SIDE. Section 197.222, Florida Statutes, allows an alternative plan for payment of property taxes. A taxpayer

who elects to pay taxes by the installment method will make payments based upon an estimated tax equal to the actual taxes

levied on the property in the preceding year.

PAYMENT SCHEDULE

First Installment

One quarter of the total estimated taxes discounted 6%. Payment is due by June 30, 20

. A

Payment

taxpayer must make the first installment payment to participate in this plan.

Second Installment

One quarter of the total estimated taxes discounted 4 1/2%. Payment is due by September 30, 20

.

Payment

No discount is allowed after September 30, 20

.

Third Installment

One quarter of the total estimated taxes, and one-half of any adjustment based on actual tax liability, with a

Payment

3% discount. Payment is due by December 31, 20

. No discount is allowed after December 31, 20

.

Fourth Installment

One quarter of the total estimated taxes plus one-half of any adjustment based on actual tax liability

Payment

with no discount. Payment is due by March 31, 20

. Interest will apply after March 31, 20

.

SEE REVERSE SIDE FOR APPLICATION AND INSTRUCTIONS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2