Form 4918 To 4920 - Michigan Flow-Through Withholding - 2014 Page 2

ADVERTISEMENT

Table of Contents

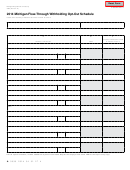

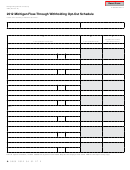

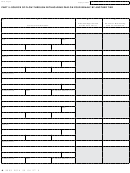

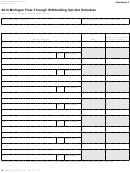

Annual Flow-Through Withholding Reconciliation Return (Form 4918) ....................................................................... Page 7

Instructions — Annual Flow-Through Withholding Reconciliation Return (Form 4918) ............................................. Page 15

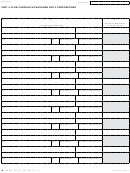

Schedule of Unitary Apportionment for Flow-Through Withholding (Form 4919) ...................................................... Page 23

Instructions — Schedule of Unitary Apportionment for Flow-Through Withholding (Form 4919) .............................. Page 25

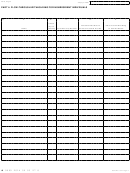

Flow-Through Withholding Opt-Out Schedule (Form 4920) ...................................................................................... Page 29

Instructions — Flow-Through Withholding Opt-Out Schedule (Form 4920) .............................................................. Page 31

2014 Michigan Flow-Through Withholding Annual Reconciliation

General Instructions

partnership, or a limited liability company that is not taxed as

Recent Developments

a C Corporation for the tax year. “Member,” for purposes of

FTW includes a shareholder of an S Corporation; a partner in a

Public Act (PA) 233 of 2013 creates an exemption from

Flow-Through Withholding for a flow-through entity that

general partnership, a limited partnership, or a limited liability

makes an election to file under the Michigan Business Tax.

partnership; or a member of a limited liability company. A “C

A flow-through entity is not required to withhold on its

Corporation” is an entity that is required to or has elected to

corporate members if it has made an election under MCL

file as a C Corporation for federal income tax purposes for its

208.1500, to continue to file a return and pay the tax imposed

tax year. A “nonresident individual” is an individual that is not

by the Michigan Business Tax. This change is retroactive and

a resident of or domiciled in Michigan in the individual’s tax

effective for all tax years beginning after December 31, 2011.

year.

Based on the recently enacted PA 295 of 2014, a flow-through

Trusts: For purposes of withholding, trusts are not considered

entity is not required to file or pay flow-through withholding

to be flow-through entities or members of flow-through entities.

to the extent that the withholding would violate any of the

Because of this, a trust is not required to be withheld on and is

not required to withhold on its beneficiaries. However, if FTW

following:

(a) Housing assistance payment programs distribution

is done for a trust for the tax year, enter amounts in Column B,

“individuals.”

restrictions under 24 CFR part 880, 881, 883, or 891.

Exception: Grantor trusts that are disregarded entities for

(b) Rural housing service return on investment

tax purposes. The flow-through entity is required to withhold

restrictions under 7 CFR 3560.68 or 3560.305.

directly on the individual “grantor” if that individual is a

(c) Articles of incorporation or other document of

nonresident individual.

organization adopted pursuant to section 83 or 93 of the

state housing development authority act of 1966, 1966 PA

Completing Michigan Forms

346, MCL 125.1483 and 125.1493.

Treasury captures the information from paper FTW returns

General Instructions

using an Intelligent Character Recognition process. If

completing a paper return, avoid unnecessary delays caused

On January 1, 2012, several changes to the Income Tax Act

by manual processing by following the guidelines below so the

of 1967 (ITA) went into effect establishing a new withholding

requirement for flow-through entities that have members,

return is processed quickly and accurately.

partners, or shareholders that are C Corporations or other flow-

• Use black or blue ink. Do not use pencil, red ink, or felt tip

through entities. These changes are in addition to the already

pens. Do not highlight information.

existing withholding requirement on flow-through entities

• Print using capital letters (UPPER CASE). Capital letters

with members, partners, or shareholders that are nonresident

are easier to recognize.

individuals. Collectively, these withholding requirements are

• Print numbers like this: 0123456789. Do not put a

known as Flow-Through Withholding (FTW).

slash through the zero ( ) or seven ( 7 ).

FTW imposes three different withholding requirements on

a

• Fill check boxes with an [X]. Do not use a check mark [

flow-through entities with Michigan business activity based

].

on the types of members of the flow-through entity. These

• Leave lines/boxes blank if they do not apply or if the

different requirements apply to members that are nonresident

amount is zero, unless otherwise instructed.

individuals, C Corporations, and other flow-through entities.

• Do not enter data in boxes filled with Xs.

For purposes of FTW, a “flow-through entity” is an entity

• Do not write extra numbers, symbols, or notes on the

that for the tax year is treated as an S Corporation, a general

return, such as cents, dashes, decimal points (excluding

partnership, a limited partnership, a limited liability

percentages), or dollar signs, unless otherwise instructed.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32